Renewables industry overview

In Angola, hydropower leads in installed capacity, followed by thermal energy, and biomass. Angola has a national strategy for new renewable energies, which was published in the Atlas and National Strategy for New Renewable Energies, which sets out the principles and objectives for the promotion and use of new renewable energy sources in Angola:

- Improve access to energy in rural areas, based on renewable energies;

- Develop the use of renewable energy linked to the grid; and

- Promote and accelerate public and private investment in renewable energy.

The global reduction in the consumption of fossil fuels in the medium and long term will result in a reduction in the price of crude oil in international markets, which could make research and production in Angola's oil fields, which are mostly in deep water, unfeasible, with high economic and environmental costs.

Hydro power

Hydro power has high reliability and allows local supply for irrigation. However, it can require population displacement, cause changes in ecosystems with a negative impact on biodiversity, and has high installation and deactivation costs.

Currently, Angola has installed around 2.4 GW of hydro power (Ministry of Energy and Water – Draft Preparation of the Master Plan for the Development of the Electric Sector in the Republic of Angola – Final Report). Angola's hydroelectric potential is estimated to be 18 GW (Atlas and National Strategy for New Renewable Energies).

Wind

In Angola, the wind resources in the southwest of the country and on the Atlantic escarpment present favorable conditions for the installation of more than 3.9 GW of wind power generation (Atlas and National Strategy for New Renewable Energies).

Solar

In Angola, solar radiation is high and constant throughout the country, having identified 17.3 GW of energy generation potential. (Atlas and National Strategy for New Renewable Energies). A Presidential Decree was recently authorized for an investment for the installation of solar panels in Bailundo, Benguela, Biópio, Cuito, Lucapa, Luena and Saurimo.

Geothermal

Angola does not show recent volcanism in geological terms, there are a few medium temperature geothermal manifestations in the provinces of Huambo (Alto Hama) and Kwanza Sul (Conda), which could have some geothermal potential.

Summary of the renewables industry in Australia

- Despite the impacts of COVID-19 continuing to have an effect on the supply chain across the globe, coupled with increased shipping costs and key commodities, the renewable energy industry in Australia remained robust in 2021.

- According to the Department of Industry, Science, Energy and Resources, 24% of Australia's total electricity generation was from renewable energy in 2020 – representing an increase of 3% since 2019

- According to the Green Energy Council 32.5% of 24% of Australia's total electricity generation was from renewable energy in 2021

- A contributing factor to this significant increase was due to the additional 3 GW of new capacity generated by the small-scale solar sector and 2 GW of new capacity generated by the large-scale sector in 2020.

- Tasmania became the first Australian state to generate 100% of its electricity from renewable energy sources and recently passed legislation to lock in a renewable energy target of 200% by 2040.

- The potential commercialization of hydrogen began to emerge in 2020 as the Federal Government and State and Territory Governments pledged to invest in renewable hydrogen, including various pilot projects and new initiatives to determine the feasibility of developing hydrogen and ammonia produced from zero-emission electrolysis.

Solar energy

- Solar energy generation has increased dramatically in Australia over the last decade and is now the fastest growing renewable energy generated in Australia, with a significant majority of large-scale solar projects being developed in Queensland.

- In 2020, the rooftop solar industry experienced record high volumes of solar panels installed, contributing to 23.5% of the total clean energy generated in Australia in 2020 and 10% of Australia’s electricity in 2020-21.

- In particular:

- 3 GgW of new capacity was generated in 2020, an increase of 0.8 GW since 2019 for small scale systems.

- 117 MW of new capacity was generated in 2020 for medium scale systems.

- 893 MW of new capacity was generated in 2020 across 22 large scale systems, thereby bringing the sector’s total capacity to 3.9 GW. Additionally, Australia’s major retailers including Woolworths, Bunnings and Aldi transitioned into the renewable market in 2020 and have committed to use 100% renewable power, accounting for 1,146 MW of deals signed in 2020.

- Some of the recent solar energy projects commissioned during 2020 include:

- the second stage of the Bungala Solar Farm in South Australia with a generation capacity of 220 MW (when combined with stages 1 and 2 of the project).

- 105 MW Nevertire Solar Farm in New South Wales.

- 100 MW Bomen Solar Farm in New South Wales.

- 100 MW Merredin Solar Farm in Western Australia.

- 100 MW Yarranlea Solar Farm in Queensland.

- And in 2022

- 150 MW Suntop Solar Farm in NSW

- 85 MW Hillston Sun Farm in NSW

Hydro power

- Hydro power electricity generation is the third leading renewable energy source in Australia and accounted for 23.3% of total clean energy generated and 6.4% of Australia’s overall electricity in 2020.

- Australia's hydro power generation capacity is at an all-time high as it currently generates 14,638 GWh of power – an increase of 573 GWh since 2020.

- A number of major hydro projects are currently being developed in Australia, the most significant of these projects being:

- the Snowy Mountains Hydro Electric Scheme in New South Wales which reached a number of significant development milestones in 2020.

- Tasmania’s Battery of the Nation project which continued to make progress in 2020.

- Marinus Link, a critical component of the Battery of the Nation project, which reached final investment decision stage after the Federal Government invested a further USD94 million into the project.

Wind energy

- According to the Clean Energy Council, wind power is currently the cheapest source of large-scale renewable energy in Australia.

- In 2020, the wind sector accounted for approximately 35.9% of Australia’s total renewable energy generation, demonstrating a 1.4% rise in total wind generation since 2019. Much of this increase was due to ten new wind farms being commissioned across Australia in 2020 which generated a total of 1097 MW in wind capacity.

- The largest project commissioned in 2020 was stage 1 of the Murra Warra Wind Farm in western Victoria which generated 226 MW of power, as well as the 184 MW Warradarge Wind Farm in Western Australia and the 144 MW Cattle Hill Wind Farm in Tasmania.

- The land use planning regime applying to wind energy varies greatly between State Governments. In recent years some State Governments have introduced new planning regulations which restrict where new wind farms may be built. A range of reasons have been cited for these amendments including concerns in some sectors of the community about the mental and physical effects of low frequency noise produced by wind turbines (“wind turbine syndrome”). For example, planning regulations in Victoria give residents who live within 2 km of a proposed wind turbine the power of veto over that project. These regulatory amendments have created an additional barrier to wind farm approvals in many areas.

Geothermal energy

- The geothermal sector in Australia is still in the infancy stages of development, contributing to approximately 0.001% of Australia’s total clean energy generation.

- In 2018, Alinta Energy announced plans to commercialize geothermal heating and cooling after successfully installing geothermal heating and cooling throughout a major housing development in Blacktown, New South Wales.

- MGA Thermal Energy Storage Project – started 2022 – project cost $2.84m - The MGA Thermal Energy Storage Project will design, manufacture and operate a 0.5 MWth / 5 MWhth demonstration-scale thermal energy storage (TES) system using MGA Thermal’s proprietary Miscibility Gap Alloy (MGA) technology.

Biomass and biogas energy

- Australia produces about 20 million tons of organic waste per year from domestic and industrial sources.

- According to the Clean Energy Counsel’s Clean Energy Australia Report 2022, bioenergy contributed approximately 1.4% of the total renewable energy generation in 2021. Some proponents suggest that in the future biogas could be more important than solar energy and as important as wind energy. These predictions have led the Australian Government to develop a roadmap to identify whether bioenergy is a viable option in generating clean energy and also inform of any investment and policy decisions in the bioenergy sector in Australia, which can be accessed here.

- Some of the notable bioenergy projects announced in 2019, all of which are (partially) funded by The Australian Renewable Energy Agency (ARENA) include:

- Logan City Biosolids Gasification, an AUD17.28 million project located in Loganholme, Queensland is Australia’s first initiative to use the Loganholme Wastewater Treatment Plant to process sewage sludge and transform it into energy.

- Hazer Process Commercial Demonstration Plant, an AUD22.57 million project located in Munster, Western Australia which seeks to convert biogas from sewage treatment into hydrogen and graphite.

- The East Rockingham Waste to Energy project will process up to 330,000 tonnes of residual waste per annum and recover energy to produce 28.9 MW of power.

- The Kwinana Waste to Energy project will develop a waste processing facility which will use moving grate technology to process approximately 400,000 tonnes of municipal solid waste, commercial and industrial waste and/or pre-sorted construction and demolition waste per annum to produce approximately 36 MW of baseload power for export to the grid.

Ocean energy

- With the assistance of ARENA providing funding support for 14 ocean projects, there has been some considerable progress in developing innovative technologies in both wave and tidal energy since 2012. Some of the most notable projects include:

- Perth Wave Energy Project which was completed on 31 December 2017, became the world’s first commercial-scale wave energy array that is connected to the Wholesale Energy Market and has the ability to produce desalinated water.

- UniWave200 King Island Project – Wave Swell which involves the design, construction, deployment, installation and operation of a 200 KW wave energy converter (UniWave200) near Grassy Harbour on King Island, Tasmania. UniWave200 will be connected to the grid through a PPA with Hydro Tasmania with an estimated operational lifetime of twelve months.

- Garden Island Microgrid Project which was completed on 31 December 2020, involved the construction and integration of 2 MW of PV solar capacity, a 2 MW/0.5 MWh battery storage system and a control system that can connect to the wave energy generation technology. This project is the world’s first wave energy integrated microgrid which can produce both power and desalinated water.

- Despite ARENA providing funding assistance for the development of these technologies, there remains slow growth in commercializing these innovations due to challenges such as capital cost, project financing, environmental impacts and developing appropriate technology suitable for utilization in extreme ocean conditions that prohibit the full utilization of these technologies.

Carbon capture and storage (CCS)

- Whilst CCS technology is successfully carried out in countries around the globe such as Canada, United States and Norway, this technology is only starting to emerge in Australia’s renewable market given its potential to reduce emissions from fossil fuel sectors and Australia’s transition to net zero emission.

- Accordingly, CCS is identified as a low priority emissions technology under the Federal Government’s Technology Investment Roadmap.

- Budget 2022-23 - $50.3 million over 2 years from 2022-23 to accelerate the development of priority gas infrastructure projects consistent with the Future Gas Infrastructure Investment Framework and support investment in carbon capture and storage pipeline infrastructure.

- The USD54 billion Gorgon project operated by Chevron is the only operating CCS project in Australia (and also the world’s largest), located in Western Australia. In July 2021, the Gorgon project failed to meet its target of capturing and burying 80% of the carbon dioxide produced from gas wells in Western Australia over five years. Notwithstanding this setback, five million tons of greenhouse gases have been injected underground since it commenced operations in August 2019.

- Other Australian CCS projects in the pipeline include:

- The CarbonNet Project – This project funded by the Victorian and Federal Government comprises of a world class, commercially viable CCS hub in Gippsland, Victoria. Once completed, it will become a commercial scale carbon transport and storage system.

- Moomba CCS Project – In November 2021, Santos and joint venture partner Beach Energy announced its final investment decision to proceed with the USD165 million (AUD220 million) Moomba carbon capture and storage project in South Australia. The Moomba CCS Project is projected to permanently store 1.7 million tons of carbon dioxide per year, with the first injection targeted for 2024.

Government plans

On 26 October 2021, the Australian Government released Australia’s Long Term Emissions Reduction Plan (Plan), a copy of which can be accessed here, in order to achieve a clean and resilient economy driven by renewables such as solar and wind instead of fossil fuels by 2050. Under the Plan, the Federal Government proposes to achieve net zero emissions by:

- providing capital costs through government funding in order to accelerate the development of technologies required to achieve net zero emissions. This includes:

- ARENA committing over AUD1.4 billion over the next 10 years, with an additional AUD75 million allocated to low emissions technologies like EV charging.

- Clean Energy Finance Corporation (CEFC) investing AUD10 billion to facilitate private sector investment in low emissions technology.

- Investing AUD565 million with overseas partners for international low emissions technology.

- Allocating AUD2.5 billion for projects through the Emissions Reduction Fund – Australia’s carbon offset scheme – and AUD2 billion for further abatement through the Climate Solutions Fund.

- Funding AUD1.2 billion for seven new clean hydrogen industrial hubs.

- Investing AUD300 million in CCS hubs and technologies.

- Spending AUD280 million to support industrial facilities to further reduce emissions using the new Safeguard Crediting Mechanism.

- building large scale infrastructure across all sectors.

- leveraging opportunities in new and traditional markets.

- partnering with other nations to accelerate innovation in low emissions technology.

Renewable energy laws

- Climate Change (Consequential Amendments) Bill 2022 was introduced to Parliament in late July 2022. If passed, will legislate Australia’s commitment to cutting its emissions by a minimum of 43% by 2030 and reaching net zero by 2050, with potential to provide greater regulatory certainty for businesses and investors across all sectors. Australia’s targets will be integrated into the functions of key Federal entities and schemes, including the Clean Energy Regulator and National Greenhouse and Energy Reporting scheme, through amending legislation.

- The Renewable Energy (Electricity) Act 2000 (Cth) sets out Australia’s target of having 20% renewable-sourced energy by 2020. The scheme established by the Act for achieving this target (the RET) aims to stimulate investment in renewables by requiring liable entities (usually electricity retailers) to purchase and surrender a certain number of Renewable Energy Certificates (RECs), in order to meet their obligation under the RET each year. RECs are created for each megawatt hour of renewable energy generated or displaced.

- Following a review of the RET, in 2011 the scheme was split into two parts – the Large-Scale Renewable Energy Target and the Small-Scale Renewable Energy Scheme. Under the new scheme RECs were replaced by large-scale generation certificates (LGCs) (generated by large-scale renewables projects) and small-scale technology certificates (STCs) (generated by small-scale renewables systems).

- LGCs are sold through the open LGC market, where prices fluctuate based on supply and demand and other market factors. As at 17 October 2019, LGC spot prices was AUD44. STCs may either be sold through the open market for an uncapped price, or through the STC clearing house at the fixed price of AUD40.

- In June 2015, the Australian Parliament passed the Renewable Energy (Electricity) Amendment Act 2015 (Cth). As part of the amendment Act, the 2020 Large-Scale Renewable Energy Target was reduced from 41,000 GWh to 33,000 GWh, with interim and post-2020 targets adjusted accordingly. The amendment Act also extended the partial exemption for emissions-intensive trade-exposed industries to a full exemption. The Small-Scale Energy Scheme has no target as such.

- Renewable energy regulation The Clean Energy Regulator (CER) is as an independent statutory authority established under the Clean Energy Regulator Act 2011 (Cth). The CER's functions include managing the:

- National Greenhouse and Energy Reporting Scheme, under the National Greenhouse and Energy Reporting Act 2007 (Cth);

- Emissions Reduction Fund, under the Carbon Credits (Carbon Farming Initiative) Act 2011 (Cth);

- Renewable Energy Target, under the Renewable Energy (Electricity) Act 2000 (Cth) and the Renewable Energy (Electricity) Regulations 2001; and

- Australian National Registry of Emissions Units, under the Australian National Registry of Emissions Units Act 2011 (Cth).

- The Australian Renewable Energy Agency (ARENA) is an independent authority that aims to, among other things, improve the competitiveness of renewable energy technologies and increase the supply of renewable energy in Australia. It has supported numerous solar and wind projects, and is currently undertaking a Renewable Hydrogen Development Funding Round. In July 2022, changes to ARENA’s financial assistance functions and funding strategy were announced, focusing their mandate on funding renewable energy technologies, clean hydrogen, low emissions metals and decarbonizing land transport.

- The Clean Energy Finance Corporation (CEFC) is an Australian Government-owned “green bank” established to provide a new source of finance for renewable energy technologies, and to facilitate increased flows of finance into the renewable energy sector.

- The Australian Energy Market Operator (AEMO) operates and manages the National Energy Market to ensure that energy can be generated, transmitted and distributed throughout the eastern and south-eastern states, and also manages the Australian gas markets and the buying and selling of energy in the financial markets to ensure that there’s an affordable, secure and reliable source of energy for Australians.

Renewables industry overview

- In 2020, Austria generated over 81% of its electricity needs from renewable energy. Austria is one of the leading countries in renewable energy generation within the EU, and particularly for hydropower.

- The Government has set a renewable energy target of 100% by 2030. These targets are underscored by implementing the Renewable Expansion Act to provide the legal means for the necessary energy structural changes.

- Austria is part of the EU Emissions Trading System, which was launched in 2005. The objective pursued for the emissions trade is to achieve a reduction of the CO2 emissions.

Hydropower

- Hydropower contributes about 62% of Austria's total electricity use. Most of the country’s hydropower capacity and potential is located in the mountains in the west, and the Danube (Austria's largest river), which hold many of the country’s largest hydropower plants. Many of the country’s most lucrative hydropower sites have already been developed.

Wind

- Wind-sourced electricity accounts for over 9% of Austria’s total electricity production. Natural conditions especially in the east of Austria are highly favourable to developing wind onshore projects. In 2020 approximately 1,300 wind turbines have been installed in Austria. These range from single small turbines (110 kW) to large turbines with 2.5 MW (or exceeding) generating capacity.

Solar

- Solar generation currently only amounts to 3% of Austria's energy supply. However, in the course of its #mission2030 Austria envisages to upscale this to 11 TWh until 2030 (from currently 2,0 TWh), which means a fivefold increase.

Geothermal

- Austria has no relevant geothermal generation activity as it only amounts to 0.3 TWh.

Biomass and biogas

- The biomass industry is well-established in Austria, including biomass such as converting organic waste from landfills to energy, liquid biofuels developing alternative transport fuel and wood energy.

- Biogas accounts for 2.4 TWh of renewable energy.

- Future growth of RES is expected to come in particular from wind energy given the country’s attractive wind speeds, and also by reshaping and further developing its PV activities (for example by initiatives such as the installation of photovoltaic systems on 1 million roofs).

Renewables laws

- Renewable Expansion Act (EAG);

- Green Electricity Act (ÖSG)

In 2021, the electricity generation mix looked as follows:

- Nuclear: 52.4%

- Gas: 24.8%

- Off-shore wind: 7.3%

- On-shore wind: 4.3%

- Solar: 5.1%

- Biogas: 2.2%

- Others: 3.8%

As for the applicable incentive schemes for renewable energy, reference is made to the questions below.

Brazil is a world leader in renewable energy, with over 75% of its generated power provided by renewable sources in 2021. The country’s natural resources enabled the development of hydro power plants, which represented 55,3% of the country’s energy generation last year, as well as biomass, wind and solar projects1.

Brazil has a massive portfolio of hydro assets and the natural resources to enable the exploration of hydro power plants, but recent water crises and climate change have shown how dependent Brazil is on hydro. When reservoirs and rivers are not sufficient to generate enough power to meet market demands, this can create issues in energy supply. In this sense, diversification via the renewables matrix is currently viewed as a sector priority.

Just in 2020-2021, solar generation grew 56% and is expected to be one of the country’s major sources in the future, attracting significant investment, both local and international.

One of the pillars of the current development of Brazil’s solar capacity is distributed generation. First regulated by ANEEL in 2012 by means of Normative Resolution No. 482/2012 (REN 482/2012), the regulatory framework of distributed generation allows consumers (both natural persons and entities) to generate their own power and inject it in the local distribution grid, creating credits to offset their power consumption bills. As of July, 2022, Brazil had over 1,131,000 distributed generation units; more than 99% of these units are solar projects, located in 5,492 cities, with over 12 GW of installed capacity.2 The recently sanctioned Law No. 14,300/22 establishes the regulatory framework of generated distribution going forward. Prior to such law, which has been extensively discussed by the sector’s entities, the only regulatory framework was REN 482/2012, as amended. One of the main differences between these two rules is the change in net metering regulations applicable to generated distribution, with some incentives being reviewed for future projects with the establishment of a transition period.

Despite the changes on the horizon, recent studies by EPE (Empresa de Pesquisa Energética) have shown that distributed generation projects are expected to receive more than BRL120 billion in investments from 2022 to 2031, and the applicable installed capacity is projected to reach over 37 GW in the same period.

Wind generation already represents a relevant portion of the power matrix and is expected to increase even further going forward, including with the installation of offshore plants. For reference purposes, wind generation increased almost 27% between 2020 and 20213. In mid-2022, wind projects have reached the important milestone of 22 GW in installed capacity, divided into 831 operational projects, with additional 414 projects under development with an authorized capacity of 15 GW.4 In addition, it is worth mentioning that the Brazilian Institute of Environment and Renewable Natural Resources (IBAMA) has received over 40 environmental licensing requests for offshore wind generation projects, with 133 GW in total.

Biomass is currently the fourth main source of power generation in Brazil. It reached over 600 operational biomass power plants in mid-2022, representing more than 16 GW in authorized capacity. Brazil’s strong sugar cane industry, one of the main sources of biomass to the power sector, is also expected to see significant growth in the next years.

1. See Electric Energy Statistic Yearbook 2022

2. See ANEEL’s Distributed Generation Information System

3. See Electric Energy Statistic Yearbook 2022

4. See ANEEL’s Generation Information System (SIGA)

Renewables industry overview

- The Canadian Energy Regulator Act provides federal regulation of renewable energy projects in Canada’s offshore waters. The Nuclear Safety and Control Act provides federal regulation of nuclear generation. All other generation is regulated provincially.

- In 2018, renewable energy sources provided about 16% of Canada’s total energy supply (including electricity and energy used for heating and motor fuel).

- Wind and solar energy are the fastest growing sources of electricity in Canada.

- In 2018, Canada ranked seventh internationally for its share of renewable energy, producing 2,421 PJ.

- In December 2020, the federal government announced a new climate plan to address climate change through Canada’s renewable energy sector, called A Healthy Environment and A Healthy Economy, with a goal of net-zero GHG emissions.

- The Smart Renewables and Electrification Pathways Program (SREPs) was launched by the federal government in June 2021, allocating CAD964 million to support smart renewable energy projects.

- Alberta has offered price supports for renewable projects (including projects with Indigenous content).

- Recently, Ontario has engaged in various procurement programmes to obtain electricity from wind power, solar and biofuel. Ontario had previously phased out coal-fired electricity and in 2019 only 6% of Ontario’s power was produced with petroleum products.

Hydropower

- Hydropower is the primary source of renewable energy in Canada, providing 60% of Canada’s electricity generation or 81, 386 MW with a total share of 68% or 1383 PJ in 2018.

- In 2018 Canada was ranked the third largest producer of hydroelectricity internationally, producing 379 TWh, with a capacity of 81,386 MW.

- British Columbia, Quebec and Manitoba rely primarily on hydroelectricity.

Biomass

- Biomass constitutes the second largest share of renewable energy production in Canada, offering a share of 23%.

- Wood derived material is the most used biomass, amounting to a total of 432 PJ.

Wind

- In 2019 Canada ranked eighth internationally in the production of wind power, with a total capacity of 13,417 MW.

Solar

- In 2019 Canada ranked ninth internationally in the production of solar power, with a total capacity of 6.27 GW.

- In 2018 the solar photovoltaic industry capacity in Canada was 3,040 MW.

Liquid Biofuels

- In 2019 Canada ranked eighth internationally in the production of liquid biofuels, with a production of 1.61 billion Litres.

Geothermal

- Several Canadian provinces have moved to remove obstacles to commercial geothermal development and several pilot-scale projects have been announced, however, geothermal energy has not yet achieved commercial scale in Canada.

Nuclear

- Canada has six nuclear plants in operation (19 reactors, all of the CANDU heavy water design), representing approximately 14,000 MW of installed capacity.

- Nuclear energy represented 59% of energy generated in Ontario in 2019 and 34% of installed capacity

- A number of the Ontario nuclear reactors, which are approaching the end of their design lifespans, are currently being refurbished

- The provinces of Ontario, Saskatchewan, New Brunswick and Alberta have announced that they will cooperate in the development and implementation of a strategy to develop small modular reactor (SMR) technology. The first SMR (300 MW) is projected to be completed as early as 2028.

- Canada has the world’s fourth largest uranium reserves, and is the world’s second largest uranium exporter. Canada produces approximately 7000 tonnes of uranium per year, 85% of which is exported

Renewables industry overview

- For the year 2022, the annual production (updated information as of June 2022) of total energy of the National Electric System (SEN) amounts to 41,585 GWh, of which 13,250.3 GWh corresponds to non-conventional renewable energies (NCRE), which is equivalent to 31.86% of the total energy generated. This percentage is over the mandatory NCRE quota, which required a minimum of 20% by 2025.

- Due to its structure and geographic diversity (solar radiation in the north and over 6,435 km of coastline), Chile has a high potential for renewable energy development, which is in line with the public policies and regulations for their promotion that have been adopted in recent years. In this context, Bloomberg's Climatescope 2021 Emerging Markets Report positioned Chile as the best country in the region and second worldwide to invest in renewable energies.

- Considering the above, and the determination to phase out coal generation, a transition to a cleaner energy mix is projected, with the expectation that, by 2035, a 80% of Chile’s power will come from renewable energies and that by 2050, 100% of the installed capacity will be sourced from renewables.

- In terms of decarbonization of the electricity mix, the Government of Chile committed in 2019 to a plan to decarbonize by 2050. In this context, it is estimated that by December 2025, 18 of the 28 coal-fired power plants in country will have closed.

- Renewable energy associations, such as the Chilean Association of Renewable Energies and Storage A.G. (Asociación Chilena de Energías Renovables y Almacenamiento A.G.), should also be mentioned. (ACERA), Asociación Chilena de Energía Solar A.G. (ACESOL), Asociación Chilena de Geotermia A.G., Asociación de Pequeñas y Medianas Empresas Hidroeléctricas A.G. (APEMEC), Asociación Chilena de Hidrógeno, among others.

- Historically, the generation of energy from hydro resources was the most predominant, together with coal-based generation (the latter, with greater intensity in the north of Chile). In the 2000s, the use of gas-fired thermal power plants increased and, subsequently, diesel and coal became more important. In the last decade, a diversification of the mix based on renewable energies has begun to take shape, which is the current and projected trend. Today, hydro, solar, wind and geothermal power generation stand out. Tidal and green hydrogen-based generation is also beginning to be promoted.

Hydro power

- By July 2022, 22.9% of energy generation was hydroelectric power. This corresponds especially to reservoirs, hydroelectric power plants and run-of-river power plants. This occurs especially in the south and central south of Chile, where there is greater availability of water and rainfall. Thus, the highest hydrological potential is found in the Biobío basin with 18%, Baker with 12% and Palena with 11%.

- Historically, electricity generation from hydro sources has had an important share. In 1897, the first Chilean hydroelectric power plant was built in Chilivilingo to illuminate the Lota mines. In 1908, the German Transatlantic Electricity Company (DUEG) installed the El Sauce power plant, the first hydroelectric plant with alternators in the country. In 1943, Empresa Nacional de Electricidad (Endesa) was created, which from that year on would be in charge of the construction of power plants. Since then, several power plants have proliferated, such as Pilmaiquén (1944), Abanico and Sauzal (1948), Los Molles (1952), Cipreses (1955), Pullinque (1962), Isla (1963), Rapel (1968), Antuco (1983), Colbún Machicura (1985), etc. Thus, hydroelectric power has been an important support for the system, with an average of about 65% in the sixties, reaching 80% in the eighties and going to a range of 30% to 40% in the last decade, depending on the year.

- It is important to note that during the 1990s there were droughts that impacted the southern part of the country, which generated water rationing policies that implied power cuts to customers.

Solar

- Chile has great potential for solar energy development, especially in the central and northern areas of the country. Thus, the northern area (the Atacama Desert, for example) is one of the most suitable places for the development of this type of energy in the world. Additionally, Chile has one of the largest reserves of lithium in the world, a material used in the production of solar panels.

- To date, the development of solar projects has been successful, with an installed capacity of at least 6,300 MW, and in June 2022, 20% of the total energy produced in the country was solar.

- As of April 2022, 4,670 MW (82 projects) are under construction, of which 53.9% are solar plants.

Wind

- Chile has good wind potential, considering its geographical distribution and extensive Pacific Ocean coastline. As of July 2022, the installed capacity corresponding to wind energy amounts to 3,810.7 MW, that represents 8.8% of the total energy produced.

- According to the July 2022 report provided by CISEN, of the 65 energy projects that are currently pending to come into operation, 11.3% are wind farms.

- There is diversity in the installed capacity of these projects, varying from projects that generate less than 3 MW to projects with a capacity close to 200 MW.

Geothermal

- Chile has a large geothermal potential estimated at 2,000 MW in the Norte Grande and 1,350 MW in the central zone. This industry has a total current installed capacity of 48 MW.

Biomass

- In Chile, biomass-based energy generation comes mainly from forestry, livestock and agricultural waste. Currently, the installed bioenergy generation capacity amounted to 502 MW (July, 2022).

Others (ocean energy and green hydrogen)

- Ocean energy: Due to its long coastline bordering the Pacific Ocean, tidal currents, as well as its strong waves, Chile is an attractive country for the development of tidal energy. Thus, it has been estimated that there is a potential for the generation of more than 160 GW based on this resource. In this context, research is currently being carried out, with the aim of studying the use of the movement of sea waves to produce energy. The Meric Technology Center has installed the first full-scale marine energy converter.

- Green hydrogen: Due to its solar and wind potential, the generation of green hydrogen is being developed as an alternative to other fuels and to support the electrical network. To this end, the Government has developed the National Green Hydrogen Strategy, which, together with parallel research, aims for Chile to become the main producer of green hydrogen in the world by the year 2030. There are already projects producing green hydrogen and an important pipeline of such projects in the development phase.

Renewable energy laws

In addition to the aforementioned laws and regulations, the following specific regulations on renewable energy are noteworthy:

- LGSE defines non-conventional renewable energy (NCRE) and in its article 150 bis regulates its attributes;

- Law No. 19,657, on geothermal energy concessions, which regulates its concession system and the relations between private parties and the State in this matter. Unlike other renewable energy sources, the legislature considers geothermal energy to be a public asset, and it may only be explored and exploited after a specific concession is granted;

- DS/ 29/2014 of the Ministry of Energy, which regulates the conditions and characteristics of tenders for the provision of annual blocks of energy with NCRE Generation Means;

- DS 119/2017 of the Ministry of Energy, which refers to the safety conditions of biogas plants;

- Decree 37/2019 of the Ministry of Energy that regulates transmission systems and transmission planning. It also regulates provisions applicable to the open access regime applicable to transmission systems, the transmission planning process and the bidding process for expansion works.

- Law of Net Billing (N°20,571 of 2012), which allows residential electrical customers to generate energy for their own consumption, to inject the surplus energy into the electrical grid, and to receive payments; and

- Decree 88 which regulates Smalls Means of Distributed Generation projects (PMGD for its initials in Spanish) for self-consumption or for commercializing their energy. The PMGD are means of generation whose surplus capacity is lower than or equal to 9 MW, and which are connected to the facilities of a distribution company or to the facilities of a company that owns electrical distribution lines that use domestic public goods, and benefit from a stabilized price regime.

- Renewable energies in Côte d'Ivoire are part of a vision of sustainable development through the adoption of sustainable modes of production and consumption to include communities in low-carbon growth strategies.

Thus, the development of the renewable sector in Côte d'Ivoire for electrical energy consumption is based on three distinct sources:- hydroelectricity

- biomass

- solar photovoltaic

The share of renewable energy in the energy mix proposed in the Electricity Generation and Transmission Master Plan (Plan Directeur Production et Transport d’électricité (PDPT)), adopted in 2014 and covering the period 2014-2030, is gradually increasing. Renewables increase from 20% (hydro only) in 2014 to 34% (23% medium and large hydro and 11% other RE sources) in 2020 to reach 42% (26% large and medium hydro and 16% other RE sources) by 2030.

Hydropower

The untapped hydroelectric potential is estimated at 7,000 MW, of which 1,847 MW is potentially economically exploitable.

The hydroelectric plants are state-owned and operated by CIE, except for the Soubré plant (275 MW), which was built with Chinese capital and for which a BOO concession contract was concluded between the government and CI-ENERGIES, which owns and operates the equipment (day-to-day management is provided by subcontractors), as CI-ENERGIES' activities were extended to power generation by decree in November 2017. It’s expected that other activities will be transferred to CI-ENERGIES in the future.

Solar

Regarding solar photovoltaic energy in Côte d'Ivoire, several projects of between 25 MW and 50 MW are taking shape, particularly in the north of the country where sunshine conditions are good.

There’s no guaranteed feed-in tariff for a fixed period of time to encourage the introduction of renewable energy, but there are incentives based on the investment code. These are targeted at specific regions and specific sizes of facilities, and within this framework, favorable regional tax measures can be expected for investments in the north of the country.

In terms of investment in renewable energy in Côte d'Ivoire, the PDER gives an estimate of the total amount of investment to be made in the 94 localities eligible for mini grids. Thus, the investment costs of hybrid solar production will require an investment of around F CFA17 billion for the 68 excluded localities, ie an average investment of F CFA250 million per locality.

Biomass

With regard to biomass energy (from agricultural residues and household waste), Côte d'Ivoire, with 1,200 million tons of biomass per year, is one of the African countries with the best opportunity. There are some plants that produce biomass energy for their own consumption of electricity. The Palmci-Biokala Project (nominal capacity: 2×23 MW) is in the implementation phase. It’s a project of a biomass power plant based on the residues of palm seeds after oil extraction. The project aims to produce 46 MW of electricity, which will be the largest biomass power plant in Africa when it is completed in 2021, using the biofuel from the 400,000 tons of plant residues from palm oil mills.

Other biomass power plants, such as a bio-gas project from landfills, are also under development. Also, there are several biomass power plants. The power of these plants varies from 40 kVA to 800 kVA. They’re located in various places: in the north, with Bafing, Bagoue and Bounkani, for example, and in the east, with Gountoug and Indenie Djuablin, but also in Gbokle in the south and Cavally in the west. In the North East in Zanzan, there is a PV-diesel mini hybrid network of 465 kW in total. The total capacity of these isolated plants is 5.6 MW, contributing 10.1 GWh in 2015.

Renewables industry overview

The most important renewable sources in the Czech Republic are hydro, wind, solar and biomass.

The aim is to become climate neutral by 2050. It will not be easy to achieve this goal, because the Czech Republic still relies heavily on the use of fossil fuels, especially coal. The Czech industry is more energy intensive than industry in other more advanced countries.

Hydropower

Although the natural conditions in the Czech Republic are not ideal for building large hydroelectric power plants, hydropower is still one of the most important sources of renewable energy. Hydroelectric power plants serve as a complementary source of electricity generation. These power plants can quickly produce high power and can operatively balance a lack of energy in the Czech power grid.

Almost all big hydroelectric power plants are built on the Vltava River. They are fully automatic and are controlled from Štěchovice. The hydroelectric power plants that are not located on the Vltava river are, for example, Dalešice and Mohelno.

The share of hydropower from all renewable energy produced in the Czech Republic was 3.6% in 2020.

Wind

The use of wind as an energy source is quite traditional in the Czech Republic. The first windmill was documented in 1277 in the famous Strahov Monastery in Prague. Wind power plants are currently located in various places in the Czech Republic. This source of energy is one of the fastest developing ways of producing renewable energy. The capacity of wind power plants ranges from small turbines, which generate about 30 kW for private use, up to 3 MW. ČEZ, operates the biggest wind farm in Europe: about 240 turbines with a total installed capacity of 600 MW.

The share of wind energy produced in Czechia was 1.17% in 2020 from all types of renewable energy.

ČEZ operates wind power plants in Dlouhá Louka nad Osekem near Litvínov city, at Mravenečník in the Jeseníky Mountains and Nový Hrádek near Náchod city.

Solar

The average intensity of solar radiation is approximately 300 W/m2 and the total energy 800-150 kWh per m2 per year.

The share of solar energy of renewable energy produced in the Czech Republic was 3.84% in 2020.

The largest photovoltaic power plants in the Czech Republic are near Brno, Mimoň and Vranovská Ves.

Biomass

Biomass is a very important energy resource. The term “biomass” usually refers to a substance of biological origin: it can be from plants, animal biomass or organic waste. Biomass is then burnt in power plants. The use of biomass is considered to be appropriate because it minimizes environmental burdens.

The share of biomass of renewable energy produced in the Czech Republic was 25.54% in 2020.

Biomass can be burned in power plants in Hodonín and Poříčí (usually wood chips) and in Jindřichův Hradec (usually straw).

Geothermal energy

There are no geothermal power plants in the Czech Republic and due to unsuitable conditions, it’s unlikely there will be any in the future.

Ocean energy

The Czech Republic is located in the heart of Europe, it is a continental state and so it does not produce any ocean energy.

Renewables laws

The most relevant Czech Act, which regulates renewable energy sources (RES) is the Act on Supported Energy Sources. It was enacted in 2012 and its main aim is to protect climate and environment. It includes:

- use of electricity and heat from renewable energy sources

- National Action Plan of the Czech Republic for Energy from Renewable Sources

- conditions for issuing, registering, and recognizing guarantees of origin for energy from renewable sources

- financing the electricity from renewable sources

- levy on solar electricity

Government plans

The Climate Change Adaptation Strategy for the Czech Republic

This strategy is a national adaptational strategy and it responds to the EU Adaptation Strategy. Its implementation document is the National Action Plan for Adaptation to Climate Change.

The Adaptation Strategy is aimed at all major manifestations of climate change in the Czech Republic. This Strategy makes up the fundamental principles of adaptation up to 2030 and even up to 2050.

The National Action Plan for Adaptation to Climate Change

This plan aims to address most serious issues of the Czech Republic, such as:

- long-term drought

- floods and flash floods

- heavy rainfall

- rising temperatures

- extreme wind

- forest fires

Renewables industry overview

- In 2020, more than half of the Danish electricity production was based on wind power. On windy days, more than 100% of the Danish power consumption is generated by wind power. Denmark is a world leader in the wind power industry thanks to key players such as Ørsted, Vestas, Siemens Wind Power and Copenhagen Infrastructure Partners. Together with these key players, a large number of developers in both wind and solar energy are making Denmark a key hub for renewable energy.

- The Danish government has set an ambitious goal to reduce Danish CO2 emissions in 2030 by 70% measured against 1990 CO2 emissions. Additionally, the official Danish target is that 100% of power production will be from renewable energy sources in 2030. It is the ambition that by 2050, Denmark will have abandoned fossil fuels completely.

- These ambitious goals are backed by tenders initiated by the Danish Energy Agency for three offshore wind parks before 2030, two energy islands and a number of near-shore wind farms. The tender for the first of the new offshore wind farms, the up to 1,000 MW Thor Offshore Wind Farm, was decided on December 1, 2021, and will be without public subsidies. The next tender for the up to 1,200 MW Hesselø Offshore Wind Farm will be decided in 2022. The two energy island projects, one in the North Sea and one near Bornholm, are intended to combine offshore wind and Power-to-X facilities.

- In recent years, development of solar parks has become a significant industry in Denmark, both in respect of parks situated in Denmark and parks situated abroad. Key players in the solar industry are Better Energy, European Energy, BeGreen, GreenGo and Obton.

Wind

- Wind-sourced electricity accounts for over 50% of Denmark’s total electricity needs. Natural conditions and Denmark’s coastline are highly conducive to developing wind projects, both onshore and offshore. Denmark has six operational offshore wind farms (Anholt, Horns Rev 1, 2 and 3, Nysted and Kriegers Flak), totaling 2,155MW, and a number of smaller nearshore windfarms. The onshore development of wind energy started in Denmark on the back of the 1973 oil crisis, and by 2020 production capacity onshore reached 4,562MW.

- While the general view in Denmark of wind-generated energy is very positive, neighbors to new projects often voice concerns. On onshore windfarms, limitations on noise pollution apply, and neighbor compensation schemes may be triggered depending on the distance to neighbors. In addition, onshore projects require zoning approval, which in the municipalities is subject to political decisions that may cause uncertainty in early-stage projects.

Solar

- Solar generation is becoming an increasingly significant part of the power supply in Denmark. While solar generation has natural seasonal variations, during summer more than 6% of Danish power consumption is now derived from solar power.

- The pipeline for new photovoltaic projects in Denmark is extensive. Several factors make solar projects very attractive for key stakeholders. For farmers, the income from leasing out farmland to solar power significantly exceeds the income from normal agricultural operations. Increasing prices on energy and decreasing prices on panels have made photovoltaic projects without subsidies attractive. Developers of solar parks have become professionalized and operate efficient businesses. There is a strong demand to invest in renewable energy which creates the option for developers to hold on to the solar parks, farm down or exit. Finally, solar parks may be financed up to 60% with the very attractive and efficient Danish long-term mortgage financing.

Biomass

- Biomass accounts for a relatively small part of the electricity production but plays an increasing role in heat production. Power plants have been modified to use biomass. Biomass is also increasingly used for production of biogas.

Geothermal

- Geothermal is currently not contributing to power production in Denmark but various projects for heating are being considered.

Power-to-X

- Focus in Denmark on future power-to-X projects is significant. The largest European plant for production of green ammonia is currently being planned near the Danish North Sea coast. The project features a production capacity for 600,000 tons of green ammonia made from renewable energy. The plant will allow the use of otherwise idle capacity when the production of renewable energy exceeds demand.

- We see a huge interest from key energy players in power-to-X and expect the area to develop significantly in the coming years in Denmark.

Summary of the renewables industry in country

- In 2021, 22,5% of electricity generated in France was from renewable sources.

- In 2020, electricity generation from renewable sources is made up of:

- 49.5 % from hydro power

- 32.4 % from wind power

- 10.8 % from solar power

- 2.9 % from biomass

- 2.2 % from biogas

- 1.7 % from renewable waste

- 0.4 % from geothermal electricity

- 0.1 % from tidal power

- In 2021, the proportion of renewable energies as a percentage of France's gross final energy consumption was 19.3%. Renewable energies in France have enjoyed significant growth since 2005, mainly because of the development of biofuels, biomass, wind power and solar energy. While the proportion of renewable energies in France’s gross final energy consumption was 24.2% in 2020, thus above France's 2020 target of 23% set out by the EU Directive 2009/28/EC on the promotion of the use of energy from renewable sources, this proportion decreased below this target in 2021 due to unfavorable weather conditions for hydropower and wind power, and this occurred despite an increase in the generation fleet.

- France aims to boost the share of renewable energy to at least 33% of total energy consumption and 40% of electricity production by 2030 and these targets are set out by law.

- The government set out specific near-term targets under the 10-year energy investment plans (programmation pluriannuelle de l’énergie or PPE) enacted in 2020. The following targets were set for the development of renewable electricity generation:

| Installed capacity as of 31 December (in GW) | 2023 | 2028 | |

| Low target | High target | ||

| Onshore wind | 24.1 | 33.2 | 34.7 |

| Solar | 20.1 | 35.1 | 44.0 |

| Hydro | 25.7 | 26.4 | 26.7 |

| Offshore wind | 2.4 | 5.2 | 6.2 |

| Biomethane | 0.27 | 0.34 | 0.41 |

Solar

- In 2021, solar electricity accounted for 3% of France’s electricity production.

- At the end of March 2022, the total installed capacity was 14.6 GW.

- The government expects that photovoltaic solar will be proportionately more developed in big solar power plants than it is today, because it is the most competitive channel and big projects (over 50 MW) will progressively be developed without subsidies, which will increase the average size of the systems. The government announced that it will ensure these projects respect biodiversity and agricultural land by prioritizing the use of industrial wasteland, neglected motorway space, military areas or even the big roof areas which will gradually become mandatory.

Wind

- In 2021, wind power accounted for 7 % of France’s electricity production.

- At the end of March 2022, total installed capacity was 19.2 GW.

- The government expects that wind power will be developed partly through renovation of existing systems that have reached expiration, enabling an increase in the energy produced while keeping an identical or smaller number of masts.

Hydropower

- Hydropower is the second most important form of electricity generation in France after nuclear energy. It represents 12% of the electricity generated in France and is the first source of renewable electricity, accounting for 53% of the country’s total gross renewable electricity production in 2021.

- France has one of the largest hydropower plants in Europe with about more than 25.7 GW deployed on its territory. The government intends to upgrade the existing facilities enabling additional generation of 200 MW by 2023 and increasing capacity by 900 - 1200 MW by 2028.

Geothermal

- Geothermal energy is a minor source of electricity generation in France, representing only 0.1% of renewable electricity production and 2.3% of renewable energies for thermal use in 2020.

- France essentially uses low and medium power geothermal energy for heating networks.

- The high-power geothermal energy for electricity generation is currently only used in two geothermal power plants. One of these plants is in Guadeloupe and uses the volcanic heat of an active stratovolcano named “La Grande Soufrière.”

Bio energy/Biomass

- The main sources for bio energy generation in France are (i) solid biomass (wood energy and other solid components), (ii) renewable waste (household waste, paper waste, agricultural waste) and (iii) biogas (produced by the fermentation of biological materials).

- In 2020, the total bio energy installed capacity amounted to nearly 2.2 GW (950 MW for waste incineration, 680 MW for solid biomass and 540 MW for biogas).

- The solid biomass energy is mainly used for the basic consumption of heat, essentially in the residential sector, only a minor part being used for electricity generation (8%).

Government plans

Changes for calls for tenders award winning projects

On August 30, 2022 the CRE announced amendments to the specifications of 17 past and ongoing calls for tenders, which is one of the Government incentives schemes for the renewable energy sector (see Government incentive schemes). This measure is taken in the context of the energy crisis and aims at allowing a quicker commissioning for 6 GW of award-winning projects (which relate to wind – 3.4 GW, solar – 2.7 GW, hydropower and self-consumption projects). These amendments will enable renewable electricity producers to:

- sell the electricity generated on the market for a 18-month period before locking in the FIP contracts (see Government incentive schemes) in order to benefit from high market prices and amortize part of the increase in costs;

- request an extension of the deadlines for completion of the facilities;

- increase the projects’ initial capacity mentioned in the call for tenders by up to 40%.

Since September 1, 2022, the producers have been able to request from the Minister responsible for energy the application of these amendments.

Speeding up the development of renewable energy projects

A draft law, which is currently under consultation and should be discussed before the Parliament in October 2022, aims to shorten the time required for commissioning renewable energy projects, by simplifying the applicable permitting requirements. Other provisions aim to facilitate the installation of solar panels on abandoned road and highway sites or in run-down areas, such as former landfills. The Government also intends to require existing outdoor parking lots of more than 2,500 square meters to install solar canopies on at least half of their surface.

Renewables laws

Several laws relating to renewables have been enacted in France. Their main provisions are consolidated in the Energy Code.

General overview of the renewable energy sector

- Ghana’s population is projected to rise to about 40 million by 2020. With the rise in energy demand surpassing supply, Ghana has committed to addressing these challenges by replacing conventional fuels with cleaner and more reliable sources of electricity.

- Ghana, like so many other African countries has adopted the United Nations Sustainable Development Goal (SDG) 7 which is targeted at ensuring universal access to affordable and modern energy.

- Ghana’s installed capacity currently stands at 5228 MW; from hydro, thermal and renewable sources as well as from independent power producers (IPPs).

- The total installed renewable energy generation capacity in Ghana according to the 2021 published energy statistics is 98.87 MW.

- The government of Ghana has set up a goal to generate 10% of its electricity from renewable energy by the year 2030.

Hydro

- Until 1998, the supply of electricity in Ghana was mainly from hydropower sources with the Akosombo (1020 MW installed capacity) being constructed in 1966. Together with the Kpong Dam (160 MW), these two large hydropower stations were the source of most of the electricity generated in Ghana. The dams are managed by the Volta River Authority. The Bui Hydro-electric power station commissioned in 2013, has an electricity capacity of 400 MW.

- Currently, hydro power accounts for 36.2% of the electricity produced in Ghana with majority of the electricity supply coming from thermal energy. A constant problem affecting hydro power generation are unrelenting hydrological shocks due to drought and unreliable rainfall patterns. These climate issues have progressively made hydro-electric power facilities unreliable because of their inability to achieve full generation capacity.

- Various sites suitable for small (mini) and medium capacity hydropower plants have been identified in different locations in Ghana with the potential to generate over 900 MW when fully developed. The exploitable hydro sites in Ghana are 22 mini-hydro and 17 medium hydro sites with individual capacities of 15 kW to 100 MW and could be exploited to generate a total of about 800 MW of electricity.

Solar

Ghana has a few solar power stations which produce a low supply of electricity:

- Navrongo Solar Power Station - completed in 2013 - produces 2.5 MW of electricity - owned by an independent power producer (IPP)

- BXC Solar Power Station - completed in 2016 - produces 20 MW of electricity - owned by an independent power producer (IPP)

- Gomoa Onyaadze Solar Power station - completed in 2018 - produces 20 MW of electricity

- Meinergy Solar Plant – 20 MW installed capacity

- Bui Solar Plant – 10 MW installed capacity

- The government also commissioned the Lawra solar plant with an electricity capacity of 6.5M W in 2020.

The country is expecting to generate 155 MW (208,999 hp) from the Nzema Solar Power station which is still under construction. Described as the largest solar power installation in Ghana when complete, the Nzema Solar Power Station will bring electricity to the homes of more than 100,000 consumers. The project is under the control of UK-Based Blue Energy ltd. Although the project was scheduled for completion in 2017, construction is still underway with the project now set to be completed before the end of 2023. This project is expected to increase the nation’s electricity generating capacity by 6%.

Biomass

- Ghana has a strong potential for biofuel production, thanks to energy crops such as jatropha, oil palm fruit, soybean, coconut and sunflower. A recent study ranked Ghana as Africa’s leading producer of biodiesel from jatropha. Generating energy from waste has also been identified as a potential source of electricity.

- The only notable project is the Safisana Biogas project which has an installed capacity of 0.10 MW.

Wind

- Average wind speeds in Ghana show possibilities for wind power project development especially along the eastern coastal areas and mountainous regions.

- The Volta River Authority is also working with two wind developers, Vestas and El Sewedy, to develop 150 MW of wind power at 4 identified sites in the southern part of the country based on wind resource potential; namely: Anloga, Anyanui, Lekpogunu and Akplabany.

- The Swiss company Nek has announced plans to generate 1000 MW of electricity from several wind farms in Ghana. The first phase is expected to generate 160 MW, and 75 MW for the second phase. The Swiss company already has major concessions in Ghana. In the locality of Amlakpo, more than 80 km from the Ghanaian capital Accra, Nek is looking to build a 200 MW wind farm on a plot of land of about 58 km².

- In the locality of Ayitepa in the south-east of Ghana, the company will develop a project for the construction of a 225 MW wind farm. Studies for the construction of this facility have been underway since 1998. Nek plans to sell the kWh of electricity generated by the Ayitepa wind farm to the state-owned Electricity Company of Ghana (ECG) at 8.9 cents.

Tidal/Wave

- Technologies to harvest energy from ocean/tidal waves are new to Ghana. So far, only one US company, TCs Energy, has expressed interest in it. However, the project was stalled for years due to financial constraints. The constraints have been resolved following the agreement signed in August, 2020 between TCs Energy, Seabased of Sweden and Power China Huadong Engineering Corporation Ltd to finance and revive the project. The project would start with 5 MW and scale up to 100 MW within 2 years.

Nuclear

- Although there have been qualms about the nuclear potential of the country, nuclear power can be considered a viable option in the national energy mix due to the increasing power demand and the country’s quest towards achieving middle-income status. According to the Ghana Atomic Energy Commission, Ghana is making steady progress to go nuclear for its electricity generation.

Legal and regulatory framework of the renewable energy sector

The legal and regulatory framework governing the renewable energy sector in Ghana, within which the renewable energy goals of the country can be achieved is found in the Renewable Energy Act, 2011 (Act 832). This Act was enacted in pursuance of Ghana’s commitment to boosting the renewable energy sector. Section 1 of Act 832 establishes that the predominant objective of the Act shall be to provide for the development, management and utilization of renewable energy sources for the production of heat and power in an efficient and environmentally sustainable manner.

The Renewable Energy Act makes provision, among others, for the following:

- Feed-in Tariffs (FITs)

- Establishment of a Renewable Energy Authority

- Renewable Energy Fund

- Research and Development

- Promotion of Clean Cookstoves

- Off-grid Electrification for Remote Communities

- Net Metering for Distributed Generation

- Renewable Energy Purchase Obligations

However, the Feed-in-tariff (FIT) scheme has been repealed by the Renewable Energy Amendment Act, 2020 (Act 1045). Act 832 was amended to enable consumers of electricity in Ghana to benefit from the reduced cost of electricity generation from renewable energy sources through competitive procurement instead of the feed-in tariff scheme.

The Renewable Energy Amendment Act 2020 also encourages small-scale self-generation and net-metering from renewables. Furthermore, it mandates fossil fuel-based wholesale electricity suppliers, fossil fuel producers and other companies that contribute to greenhouse gas emissions to complement the global effort of climate change mitigation by investing in non-utility scale renewable energy technologies, particularly for off-grid electrification

In 2012, the Energy Commission developed a licensing manual for service providers in the renewable energy sector to regulate the technical operations of service providers in the sector. The manual was prepared in accordance with Section 8 of the Renewable Energy Act, 2011 (Act 832). As of November 2019, 130 provisional licenses, 40 siting permits, 11 construction permits and 4 operational licenses had been granted

Aside the Renewable Energy Act which serves as the primary legislation on generation of energy from renewable sources, other tangential pieces of legislation such as the Environmental Protection Agency Act, 1994 (Act 490), th Bui Power Authority (Amendment)Act, 2020 (Act 1046), The Revenue Administration (Amendment) Act, 2020 (Act 1029).

Policy framework

Ghana has instituted a number of policies and measures aimed at promoting the development of renewable energy technologies, particularly, incentives that will attract renewable energy investors.

- Strategic National Energy Plan (SNEP) 2006-2020: Developed by the Energy Commission, the goal of this policy was to provide a sound energy market and to ensure the provision of sufficient energy services for Ghana. In contrast, the target of the Strategic National Energy Plan was to boost the renewable energy market. The renewable energy objective of this policy aimed at increasing the share of renewables up to 10% by 2020 while ensuring energy efficiency and conservation and achieving universal access to electricity by the year 2020.

- National energy policy (NEP), 2010: This policy was geared towards the development of an energy economy to ensure secure and reliable energy supply to all Ghanaians. Intended as a provisional update to SNEP, this policy reaffirmed the nation’s commitment to renewable energy development. The energy sub-sector was introduced under the National Energy Policy 2010 to increase the proportion of renewable energy in the total national energy mix and to focus on the fiscal incentives, awareness creation and regulations to promote energy efficiency and conservation practices. The policy also set the target to achieve 10% of renewables by the year 2020, reduce the consumption of wood fuels from 66 to 30% by 2020 and encourage the use of clean cooking alternatives such as LPG, and efficient cookstoves.

- Energy sector strategy and development, 2010: This policy sets the goal and strategies to increase (i) the percentage of renewable in the total national energy mix and efficient use of stoves and (ii) establish legislation to encourage the development of renewable energy technologies.

- The sustainable energy for all action plan (SE4ALL), 2012: This action plan had as its target, universal access to electricity to island and riverside communities through on and off grid systems and providing universal access to clean cooking solutions. The UNDP has collaborated with some partner agencies to achieve universal access to energy by 2030.

- Bioenergy Policy: This policy was drafted to promote and develop bioenergy technology in sustainable supply and encourage its usage for energy security without compromising food security in the country. It is also meant to encourage the use of biomass waste for heat and electricity generation.

- Renewable Energy Master Plan, 2019: The REMP seeks to accomplish the targets enumerated in the previous policies - with some additions - by the year 2030.

Issues with the policy framework

- There is no long-term strategic plan and thus, most of the renewable energy projects are on pilot basis or on short-term basis. This had led to a constant shifting of timelines. The failure to set clear action plans as well as create viable renewable energy projects may signal to potential investors that the renewable energy is not a key priority for the government.

- The drive of the government towards complete electrification creates a split focus on the part of the government. This is another reason why electricity generation from (non-hydro) renewable sources stands at less than 1% in 2021.

Institutional framework

- Ministry of Energy: Formulates policies and some aspects of their implementation, and monitoring and evaluation

- Ministry of Environment, Science, Technology and Innovation Regulatory Agencies

- Public Utilities Regulatory Commission (PURC): Sets electricity tariffs and protect consumers through monitoring the quality of services provided by the utilities.

- Energy Commission (EC): Provides license and sets technical performance standards for operators in the renewable energy sector, planning for the sector, and provides policy advice to Minister of Energy

- National Petroleum Authority (NPA): Ensures that correct fraction and price of biofuel in biofuel blend are in line with the agreed petroleum pricing formula.

- Ghana Standards Authority: Develops and monitors standards for renewable energy technologies and biofuel.

- Forestry Commission: Supports development and execution of programs for sustainable wood fuel production and usage.

- Environmental protection Agency: Protects and improves the environment and helps with the implementation of environmental policies

Other agencies

- Volta River Authority

- Bui Power Authority

- Independent Power Producers (IPPs)

- Ghana Grid Company (GRIDCo)

- Electricity Company of Ghana (ECG)

- Northern Electricity Distribution Company (NEDCo)

- Enclave Power Company

- Bulk Oil Storage and Transportation Company (BOST)

- Oil Marketing Companies (OMCs)

Renewable energy overview

- Based on commercially available technologies, it is estimated that Hong Kong has a renewable energy potential of about 3-4% of total electricity consumption arising from wind, solar and waste-to-energy that can be exploited between now and 2030. In 2018, the amount of electricity generated from renewable energy accounted for less than 1% of power consumption in Hong Kong.

Solar

- Currently, the largest solar energy generation system in Hong Kong has been installed at the Hong Kong Disneyland Resort, which has a capacity of 2,100 KW and is comprised over 5000 monocrystalline solar panels on the rooftops of 20 buildings.

- The current cumulative photovoltaic (PV) installation capacity in Hong Kong is less than 5 MW. There are over 200 relatively small projects in Hong Kong, where PV panels and solar water heaters have been installed mainly at schools and on the rooftops of public sector buildings and facilities as a result of the Hong Kong Government taking the lead to encourage the use of solar energy to generate electricity.

Wind

- Since 2000, the Hong Kong Observatory began to use wind power as an energy source in some remote automatic weather stations which have been relying on solar power. As sunshine in cloudy days may not be sufficient to keep the operation of those weather stations, wind turbine generators have been employed to provide an alternative energy source.

- The first commercial-scale wind power station was completed in February 2006 on Lamma Island, operated by HKE. The rotor diameter is 50 meters with a rated output power of 800 KW.

- Studies show that Hong Kong has two potential sites for developing wind power on a commercial scale, one at South West Lamma with the potential to develop a 100 MW capacity wind farm producing 175 GWh of electricity annually and another at South East Ninepin with potential to develop a 200 MW wind farm.

Solar & wind

- The first wind/solar hybrid system in Hong Kong was installed at the Shek Kwu Chau Drug Rehabilitation Centre. The first commercial-scale combined PV and wind turbine renewable energy power station at 200 kW capacity on Town Island was completed in 2011.

Waste-to-energy

Landfill

- There are three strategic landfills in Hong Kong, namely West New Territories Landfill, South East New Territories Landfill and North East New Territories, which have been utilizing landfill gas for energy production. The current uses include generating electricity for use in on-site infrastructures.

- The surplus landfill gas generated from North East New Territories Landfill is treated and delivered to Hong Kong & China Gas' (HKCG) production plant in Tai Po for use as alternative energy source.

- The surplus landfill gas generated from South East New Territories Landfill is treated (in the form of synthetic natural gas) and conveyed to HKCG's Offtake Station at Tseng Lan Shue, where the treated gas is blended with town gas for injection to the supply grid for HKCG's customers.

- Apart from the strategic landfills mentioned above, there are 13 closed landfills. The landfill gas generated from some of the larger closed landfills, namely Shuen Wan, Gin Drinkers Bay, Jordan Valley, Tseung Kwan O Stage I, II and III and Pillar Point Valley landfills, has been used as an energy source.

- For Shuen Wan Landfill, a special arrangement has been made with HKCG for piping the landfill gas to their plant for utilization. Landfill gas is also used as fuel in electricity generation to meet on-site uses in Jordan Valley and Tseung Kwan O Stage I landfills. For Gin Drinkers Bay, Tseung Kwan O Stage II/III and Pillar Point Valley, the landfill gas is used as a thermal energy source in the treatment of landfill leachate.

Biogas

- Hong Kong has been utilizing biogas from digesters in the sewage treatment works in Sha Tin, Tai Po, Fan Ling, Yuen Long for a number of purposes – in boilers for producing hot water for the digesters, in engine-driven blowers to provide compressed air for the sewage treatment process, and in engine-driven electric generators to provide electricity for the sewage treatment works.

- An example is the 330 KW engine-driven combined heat and power generator at Shek Wu Hui Sewage Treatment Works, which was commissioned in 2006 and subsequently connected to CLP’s distribution network in 2008. The electricity generated is supplied to existing E&M facilities while the recovered thermal energy is used for pre-heating the recirculation water for maintaining the required temperature for the sludge digestion process in the sewage treatment works.

Renewables industry overview

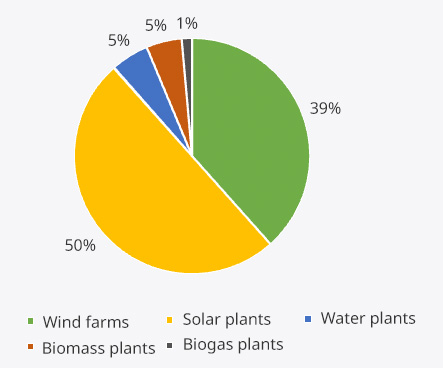

In Hungary, the use of renewable energy sources is getting more and more widespread. The most up to date official data provided by MEKH is for the month of August 2021. Of the 2,905 GWh of electricity generated in this period, 43.6% was nuclear, 22% was provided from natural gas, 10.8% by coal and coal products, 22.4% by renewables and 1.1% by other sources. Of the electricity generated from renewable energy sources, 68.8% was provided by solar, 18.1% by biomass, 5% by wind, 3.4% by biogas, 2.8% by hydro and 2% by the renewable fraction of municipal waste. Compared to the same period last year, solar and wind increased, while the amount of energy from water, biomass, biogas and the renewable fraction of municipal waste decreased.

In January 2020, the Hungarian government adopted the new National Energy Strategy, which sets out Hungary's energy and climate policy priorities until 2030 (with an outlook to 2040). The new National Energy Strategy focuses on clean, smart and affordable energy services.

Hydropower

Due to the unfavourable geographical conditions, there are only a few hydroelectric power plants in Hungary. The two largest ones are located on the Tisza river, the Tiszalök power plant has an installed capacity of 12.5 MW and the Kisköre power plant has an installed capacity of 28 MW. There are also other hydroelectric power plants with smaller capacities in the country, mainly on the Rába river (e.g. Ikervár hydropower plant).

Wind

Most of the wind farms are located in North-west Hungary, where the natural conditions are most favourable for optimal power generation. The legal environment does not support the implementation of new wind farms, therefore the capacities are stuck on the same level in the last years. The Government supports the establishing of solar power plants instead of wind farms.

Solar

The use of solar energy is growing dynamically in Hungary, but it still lags behind Western Europe. Between 2015 and 2021, the capacity increased by an average of 64% annually. In 2021, solar power plants in the country had a total capacity of over 2850 MW. The largest solar power plants in the country are located in Kaposvár (100 MW), Kaba (43 MW) and Kapuvár (25 MW).

Geothermal