We are now 11 months after the application of the legislative framework known as the second Markets in Financial Instruments Directive 2014/65/EU (MiFID II) across the European Union.

Seven years in the making and comprising a staggering 1.4 million paragraphs (taking into account delegated measures), MiFID II is designed to make European financial markets more transparent and strengthen consumer protection. To this end, MiFID II revises certain rules and regulations for investment firms and trading venues as well as imposing new ones.

Ascertaining whether MiFID II has been successful in obtaining its ambitious objectives will require more time and analysis. One area however where MiFID II has had an impact already is in pushing trading away from so-called ‘dark pools’ by the Double Volume Cap (DVC) mechanism. On 9 November 2018, the European Securities and Markets Authority (ESMA) published its latest data on the DVC.

Dark Pools

One of the objectives of MiFID II is to protect the integrity of the price formation process by limiting the amount of trading which occurs in ‘dark pools’. Dark pools are private trading venues where prices are disclosed only after a trade has been completed. This contrasts with exchanges and other ‘lit’ trading venues where deal information must be displayed before a trade is executed. The absence of so-called ‘pre-trade transparency’ has made dark pools attractive to fund managers who are reluctant to trade large blocks via a public exchange, as this can alert other investors of their intentions and push prices against them. The limited ability of regulators to monitor trading in the dark however has led to concerns that traders are not being provided best execution and that dark pool operators may have conflicts of interest and / or inadequate systems and controls.

Double Volume Cap

The DVC mechanism was introduced by Article 5 of the Markets in Financial Instruments Regulation 600/2014 (MiFIR). It limits trading under waivers from pre-trade transparency requirements set out in Article 4(1)(a) and Article 4(1)(b)(i) of MiFIR by imposing two caps on trading in the ‘dark’.

The first cap is reached when the percentage of trading in an instrument on a single trading venue under the waivers exceeds 4% of the total volume of trading in that instrument on all EU trading venues over the preceding year. This means that only 4% of an instrument (like a particular share) can be traded in any dark pool over 12 months. The second cap is reached when the volume of trading in an instrument on all trading venues under the waivers crosses the 8% threshold of the total volume of trading across all EU trading venues over the previous year. This means that only 8% of the total volume can be traded across all dark pools. Approximately three quarters of European stocks are affected by the DVC.

Earlier in the year, ESMA dramatically announced that the DVC would be delayed as ESMA had not received the complete data from the trading venues in time for the commencement of MiFID II on 3 January 2018. The data issues were subsequently corrected and ESMA commenced publishing data on equities and equity-like instruments that breached the DVC thresholds on 7 March 2018 and then again published data on 10 April, 8 May and 8 June 2018. The equities and equity-like instruments were effectively banned from being executed in dark pools whilst they continued to breach DVC thresholds.

Latest DVA Data

On 9 November 2018, ESMA published its latest DVC data under MiFID II for the period of 1 October 2017 to 30 September 2018 as well as updates to already published DVC periods.

On 8 October 2018, ESMA published updated DVC data and calculations for the period 1 September 2017 to 31 August 2018 as well we updates to already published DVC periods. The number of new breaches of the DVC thresholds is 48: 42 for the 8% cap and 6 for the 4% cap.

This brings the total number of instruments suspended from trading in dark pools to 630, down from 652 in October 2018.

What is the impact on dark trading?

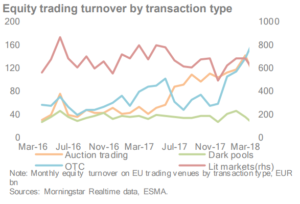

In ESMA’s Trends, Risks and Vulnerabilities Report (No.2, 2018) the regulator noted that cross-Europe dark pool volumes shrank from almost 9% to 0.15% by the end of May 2018. However, it also noted that over-the-counter (OTC) trading volumes surged upwards to €188 billion, three times higher in May than OTC volumes in December 2017.

Instead of the DVC pushing ‘dark’ trading from dark pools onto ‘lit’ markets like exchanges, it would appear that trading volumes are instead moving to off-exchange, OTC or specialist auction services. The initial impact then of the DVC and MiFID II generally appears to have had the unintended consequence of moving trading volumes away from more ‘lit’ transparent trading venues. As time goes on, more data will enable us to ascertain whether this trend will continue.