On 7 June, the Australian Government released a consultation paper, seeking feedback on its proposals for a new payment licensing framework including a new list of regulated payment functions. The full paper is available here and we have prepared the below summary of the key proposals.

The paper proposes a significant overhaul of the Australian payment licensing framework. Key consequence of the proposed changes (if they go ahead as proposed in the paper) include that:

- new AFSL authorisations will be required by existing licensees;

- certain payment service providers who have not historically been caught by the regulatory framework (either because an exemption applies or because the scope of the current framework does not clearly capture them) will become subject to AFS licensing and regulatory obligations. This includes that the new framework proposes to potentially regulate BNPL providers, merchant acquirers, payment gateways/processors and remittance service providers; and

- major stored value facility providers (store more than AUD50 million in customer funds, offer individual customers the ability to store more than AUD1,000 for more than 31 days, and allow their customers to redeem their funds on demand in Australian currency) will be dual regulated by APRA and ASIC, and so will need to comply with APRA prudential requirements as well as AFSL obligations. This will replace the current regulation for purchased payment facilities.

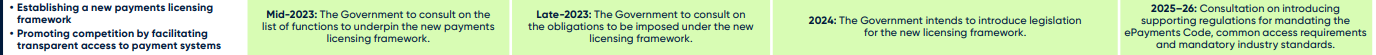

The consultation seeks feedback on the list of payment functions that will be regulated, and also on how they will be integrated into the regulatory framework. The consultation process is open until 19 July 2023. Further, more detailed, consultation on the obligations that will apply to regulated payment service providers is due later this year and then it is anticipated that legislation will follow in 2024 (see below a snapshot of the Government’s current proposed timing). We anticipate draft legislation would be released before any final legislation is introduced to Parliament.

In parallel, the Government is also consulting on changes to the Payments Systems (Regulation) Act 1998 (PSRA) (with draft legislation expected later in 2023). That consultation is available here and includes proposals for the following:

- Update the legislation so the RBA has the ability to regulate new and emerging payment systems (such as digital wallet providers). This would be achieved by redefining:

- ‘payment system’ to apply to “an arrangement or series of arrangements for enabling or facilitating payment or transfer of value, or a class of payments or transfer of value, and includes any instruments and procedures that relate to the arrangement or series of arrangements”; and

- ‘participant’ to include corporations that provide services to a payment system or provide services for the purposes of enabling or facilitating a transfer of value using a payment system.

While this is intended to cover all entitles in the payment value chain, it does not mean all those who fall within the definition of ‘participant’ will be regulated. The Treasurer must still make a decision that they should be regulated because of ‘public interest’ (per existing pathway in the PRSA) or ‘national interest grounds’ (see below).

- Introduce a new ministerial designation power that would allow particular payments services or platforms that present risks of national significance to be subject to additional oversight by appropriate regulators (this would be in addition to the RBA’s current power to designate a payment system if it is in the ‘public interest’). It is envisaged that in making a decision based on the national interest under the PSRA, the Treasurer would have regard to a range of factors including, but not limited to national security, consumer protection, data-related issues, innovation, cyber security, anti-money laundering and counter-terrorism financing and crisis management.

The PSRA consultation is open until 7 July 2023.

We’re happy to discuss any of the above proposals in further detail, including what it could mean for your business.