Angola

There are no specific laws applicable to fintech products. General legislation, such as the consumer protection act or the personal data protection law, among others, are applicable to said products.

Australia

General financial regulatory regime

ASIC is the financial services regulator in Australia.

General

To conduct a financial services business in Australia, businesses must hold an AFSL issued by the ASIC. Most FinTech services are captured in the definition of financial services and financial products in the Corporations Act 2001 (Cth) and unless an exemption applies, FinTech companies will require an AFSL. There are limited statutory exemptions available to foreign entities who conduct financial services in Australia.

Additionally, an Australian credit license (ACL) issued by ASIC is required for a business engaging in consumer credit activities in Australia which are captured in the National Consumer Credit Protection Act 2009 (Cth), unless an ASIC exemption applies.

National Innovation and Science Agenda

In December 2015, the Australian Government introduced the National Innovation and Science Agenda (NISA) to facilitate the development of FinTech. NISA, among other things:

- encourages investment in FinTech companies through tax incentives for early-stage investment;

- enables crowdsourced equity funding of public companies (described further below); and

- establishes the FinTech Advisory Group to advise the Treasurer and the ASIC Innovation Hub.

The ASIC Innovation Hub assists FinTech startup companies to navigate the Australian financial regulatory system by engaging with FinTech businesses and providing information to streamline the licensing process.

Electronic payments platforms and regulation of peer-to-peer lenders

Electronic payment platforms

The New Payments Platform (NPP) is an industry initiative to develop a new national infrastructure for fast, versatile, data-rich payments in Australia between financial institutions and their customers. The NPP will connect to all financial institutions and, as a result, to businesses and consumers, allowing funds to be accessible almost immediately upon receipt of a payment.

Peer-to-peer lenders

Peer-to-peer lending involves a financial service provider (the lending platform) acting as the intermediary between investors and borrowers. Lending platforms are generally set up as managed investment schemes, meaning the platform operator must have an AFSL that allows them to run the scheme. Accordingly, these transactions will be caught by the Corporations Act 2001 (Cth) and must comply with the regulatory regime.

Where the borrower is an individual and not a business, the loan will be a consumer credit contract and the platform operator will be required to comply with the National Consumer Credit Protection Act 2009 (Cth), in addition to holding an AFSL.

Regulation of payment services

The Reserve Bank of Australia

RBA is responsible for the designation and regulation of systems facilitating the transfer of funds in Australia under the Payment Systems (Regulation) Act 1998 (Cth) and the Payment Systems and Netting Act 1998 (Cth). The RBA has established the Payment Systems Board to take responsibility for the payments system policy. The powers of the RBA include designating a payment system as being subject to regulation, imposing an access regime to establish rules of participation in a payment system and setting standards for payment systems to promote safety and efficiency.

To this end, the RBA has established a number of standards for compliance and access regimes applicable to participants in payment systems.

ePayments Code

Consumer electronic payment transactions in Australia are regulated by the ePayments Code, administered by ASIC. The ePayments Code applies to voluntary subscribers, including banks, credit unions and building societies.

The Code, among other things:

- requires subscribers to give consumers clear and unambiguous terms and conditions;

- stipulates how terms and conditions changes (such as fee increases), receipts and statements need to be made;

- sets out the rules for determining who pays for unauthorized transactions; and

- establishes a regime for recovering mistaken internet payments.

Application of data protection and consumer laws

The Privacy Act 1988 (Cth) regulates the use of personal data within Australia. Where a FinTech business provides credit or handles information relevant to credit, the Privacy Act will apply. The Australian Privacy Principles that are set out in the Privacy Act outline the obligations on the collection, use, disclosure and management of personal information. Where a business undertakes an act outside Australia and there is some link to an Australian citizen or organization, or where it carries out business in Australia, the Privacy Act will apply.

The Office of the Australian Information Commissioner (OAIC) is the body responsible for administering the Privacy Act and has the power to investigate non-compliance.

Money laundering regulations

The Anti-money Laundering and Counter-terrorism Financing Act 2006 (Cth) establishes a regime to target and deter money laundering and terrorism financing in designated services. Where a FinTech company provides a designated financial service, such as lending or issuing or selling interests in managed investment schemes, they will become a reporting entity and have obligations under the Anti-money Laundering and Counter-terrorism Financing Act 2006 (Cth). These obligations include compliance reporting and conducting due diligence on customers prior to engaging in any financial services.

Licensing exemption for FinTech testing

ASIC has implemented a FinTech licensing exemption, to facilitate the testing of new FinTech services before requiring a business or start-up to obtain an AFSL or ACL. Based on the regulatory guide published by ASIC, allowing FinTech businesses to test their new products and services before they obtain a license can help alleviate the barriers to innovation (including access to capital and speed to market) by:

- allowing concepts to be validated and refined before businesses spend the time and money associated with obtaining a license; and

- providing increased opportunities for businesses to obtain investment that may assist with meeting the costs of complying with the law.

Three components are necessary in this regard:

- existing flexibility in the regulatory framework or exemptions provided by the law which means that a license is not required;

- tailored, individual licensing exemptions granted by the ASIC to a particular business to facilitate product or service testing (individual exemptions of this nature are similar to the regulatory sandbox frameworks established by financial services regulators in other jurisdictions); and

- ASIC’s ‘FinTech licensing exemption’ – provided under ASIC Corporations (Concept Validation Licensing Exemption) Instrument 2016/1175 and ASIC Credit (Concept Validation Licensing Exemption) Instrument 2016/1176, which apply to certain products or services (FinTech Exemption).

Under the FinTech exemption, a business may, without needing to hold an AFSL, give financial product advice in relation to (or deal in) the following products:

- listed or quoted Australian securities;

- debentures, stocks or bonds issued or proposed to be issued by the Australian Government;

- simple managed investment schemes;

- deposit products;

- some kinds of general insurance products; and

- payment products issued by Australian banks.

Initial Coin Offerings

The ASIC is due to release guidelines in relation to Initial Coin Offerings (ICOs) (which have not been released to date). It is expected that the ASIC will follow the lead of the US, Canada and Hong Kong regulators by including the fundraising method within the regulatory framework governing Initial Public Offerings. The ASIC is reportedly working with advocates in the startup community (including FinTech Australia), to develop guidelines although it is expected that the ASIC may take the view that many of the 'tokens' currently being issued through ICOs would fall within ASIC definitions of 'securities'.

Crowdfunding in Australia

Australia’s previous regulatory requirements generally created a barrier to widespread use of crowdsourced equity funding. However changes are underway to make it easier and less expensive for businesses, including start-ups, to raise equity from the general public up to A$5 million in any 12-month period, while ensuring adequate investor protection. However, the Australian Parliament has enacted the Corporations Amendment (Crowd-sourced Funding) Act 2017 (Cth), which will allow eligible Australian businesses (including start-ups) to access crowdsourced equity investments through a licensed online portal.

For companies to access the benefits of the new crowdsourced funding regime, providers of crowdsourced funding services must hold an AFSL issued by ASIC. ASIC accepts applications from potential crowdsourced funding intermediaries for AFSL authorizations to provide crowdfunding services.

The following general restrictions apply:

- Individuals seeking to invest using a crowdsourced funding platform can contribute up to AUD10,000 per year, per company.

- Crowdsourced funding will also be available to Australian public companies with turnover/gross assets less than AUD25 million.

- Proprietary companies will be subject to additional governance and reporting requirements (including the provision of annual financial reports to shareholders).

Belgium

Regulation of payments services

Businesses that aim to provide payment services require prior authorization from the NBB under the Law of Law of 11 March 2018 transposing the Second European Union Payment Services Directive (PSD II). In order to become authorized, payment service providers need to meet certain criteria, including in relation to the business plan, initial capital, processes and procedures in place for safeguarding relevant funds, sensitive payment data and money laundering and other financial crime controls.

Application of data protection and consumer laws

The European General Data Protection Regulation (GDPR) entered into force with direct effect on 25 May 2018. The GDPR offers citizens a wider control around the use of their personal data.

Money laundering regulations

The Law of 18 September 2017 on the prevention of money laundering and terrorist financing and on the restriction of the use of cash implements the Fourth Anti Money Laundering Directive (4AMLD). Suspicious transactions have to be reported to the Belgian Financial Intelligence Processing Unit. As mentioned above, the Belgian Minister of Justice intends to bring virtual currency exchanges into the scope of the Belgian Anti-Money Laundering Act in the future.

Brazil

General financial regulatory regime

The basic structure of the Brazilian financial system (Sistema Financeiro Nacional) was established by Law No. 4.595, which created the CMN (as defined below) and granted the Central Bank, among other things, the powers to issue money and control credit.

Main regulatory agencies

The Brazilian financial system (Sistema Financeiro Nacional) consists, among others, of the following regulatory and fiscal bodies:

- National Monetary Council (Conselho Monetário Nacional or CMN);

- Central Bank of Brazil;

- Brazilian Securities Commission (Comissão de Valores Mobiliários or CVM);

- Brazilian Council of Private Insurance (Conselho Nacional de Seguros Privados – CNSP);

- Superintendence of Private Insurance (Superintendência de Seguros Privados or SUSEP); and

- Complementary Pensions Secretariat (Superintendência Nacional de Previdência - PREVIC).

The CMN and the Central Bank regulate the Brazilian banking sector. The CVM is responsible for the policies of the Brazilian securities market. Below is a summary of the main attributes and powers of each of these regulatory bodies.

The CMN

Currently, the CMN is the highest authority in the system and is responsible for Brazilian monetary and financial policy and for the overall formulation and supervision of monetary, credit, budgetary, fiscal and public debt policies.

The Central Bank

Law No. 4,595 granted the Central Bank powers to implement the monetary and credit policies established by the CMN, as well as to supervise public and private sector financial institutions and to apply the penalties provided for in law, when necessary. According to Law No. 4,595, the Central Bank is also responsible for, among other activities:

- controlling credit and foreign capital;

- receiving mandatory payments and voluntary demand deposits from financial institutions;

- carrying out rediscount operations and providing loans to banking institutions;

- functioning as the depositary for official gold and foreign currency reserves;

- controlling and approving the operations, the transfer of ownership and the corporate reorganization of financial institutions;

- the establishment of transfers of principal places of business or branches (whether in Brazil or abroad); and

- requiring the submission of periodical and annual financial statements by financial institutions.

The President of the Central Bank is appointed by the President of Brazil, subject to ratification by the Federal Senate, and holds office for an indefinite period of time.

The CVM

The CVM is a government agency of the Ministry of Economy, with its headquarters in Rio de Janeiro and with jurisdiction over the whole Brazilian territory. The agency is responsible for implementing the securities policies of the CMN and is able to regulate, develop, control and supervise this market strictly in accordance with the Brazilian Corporate Law and securities laws.

The CVM is responsible for regulating the supervision and inspection of publicly-held companies (including with respect to disclosure criteria and penalties applicable to violations in the securities market), the trading and transactions in the securities and derivatives markets, the organization, functioning and operations of the stock exchanges and the commodities and futures exchanges and the custody of securities.

Electronic payments platforms and regulation of peer-to-peer lenders

Electronic payment platforms

Law No. 12,865/2013 regulates the payment schemes and payment institutions, which have become part of the Brazilian Payments System. A number of FinTech businesses are offering electronic payment platforms to rival the traditional payment systems.

Peer-to-peer lenders

The CMN approved on April 26, 2018, resolutions No. 4,656 and 4,657, regulating the activities of financial technology companies that operate in the credit market and enabled these companies, which used to operate as banking correspondents in the credit market, to grant credit without the intermediation of a bank. The new rules applied immediately to these entities and allowed interested companies to start the authorization process.

As per the approved regulation, FinTechs could be structures as (i) Direct Credit Companies, which will carry out operations with their own resources through an electronic platform; or (ii) Interpersonal Loans Company, focused on financial intermediation (peer-to-peer). Furthermore, on October 29, 2018, the Federal Government enacted Decree No. 9,544, authorizing the foreign investment up to 100% in the capital stock of Direct Credit Companies or Interpersonal Loans Company.

Regulation of payment services

General overview

A payment institution in Brazil is a legal person subject to the Central Bank’s provisions, adhering to one or more payment schemes, having as main or ancillary activity one or more of the following (a Payment Institution):

- providing cash-in and cash-out services of the funds held on payment accounts;

- performing or facilitating payment instructions related to definite payment service, including transfers originated from or intended for a payment account;

- managing payment accounts;

- issuing payment instruments;

- acquiring payment instruments;

- remit funds;

- converting physical or book-entry currency into e-money, or vice-versa, acquiring the acceptance or managing the use of e-money; and

- other activities related to payment services, designated by the Central Bank.

Legal framework

Payment Institutions in Brazil are subject, primarily, to the following laws and regulations:

- Law No. 12,865/2013, as amended, regulates the payment schemes and payment institutions, which have become part of the Brazilian Payments System (SPB);

- Resolution No. 4,282/2013 presents a guideline for the regulation of the Central Bank regarding payment schemes and payment institutions;

- Central Bank Circular No. 3,680/2013, as amended, regulates payment accounts;

- Central Bank Circular No. 3,681/2013, as amended, regulates the risk management, minimum capital requirements and governance of payment institutions, among others;

- Central Bank Circular No. 3,682/2013, as amended, regulates payment schemes within the SPB;

- Central Bank Circular No. 3,885/2018, as amended, regulates payment institutions;

- Central Bank Circular No. 3,856/2017 provides for the internal audit activity in the institutions of payment;

- Central Bank Circular No. 3,704/2014 regulates the account held at the Central Bank regarding e-money and the performance of the payment institutions and transfer of reserves system (Sistema de Transferência de Reservas – STR);

- Central Bank Circular Letter No. 3,949/2019 provides clarifications and models regarding the procedures to request authorization for payment schemes;

- Central Bank Circular Letter No. 3,897/2018 provides models of necessary documents to support the proceedings addressed in Central Bank Circular No. 3,885/2018;

Categories

Under Article 4 of Circular No. 3,855, payment institutions are classified in the following categories, according to the services that will be rendered:

| Category | Services rendered |

| Issuer of e-money |

|

| Issuer of post-paid payment instrument |

|

| Accrediting entity |

|

Operations

According to Circular No. 3,855, the essential conditions for a Payment Institution to operate are:

- due incorporation according to the current rules and regulations;

- Central Bank authorization (only for payment institutions that operate with a volume greater than R$500 million in payment transactions or R$50 million in funds held in prepaid payment account for any given period of 12 months); and

- compliance with the minimum capital requirements in case the payment institution is authorized by the Central Bank.

Application of data protection and consumer laws

Brazilian Consumer Defense Code

Financial activities are also generally subject to the restrictions of the Consumer Defense Code and certain other related regulations from the Central Bank. In 1990, the Brazilian Consumer Defense Code was enacted to establish rigid rules to govern the relationship between product and service providers and consumers with the overall aim to protect final consumers. In June 2006, the Brazilian Supreme Court of Justice ruled that the Brazilian Consumer Defense Code also applies to transactions between financial institutions and their clients. Financial institutions are also subject to specific regulation from the National Monetary Council (CMN), which regulates the relationship between financial institutions and their clients. CMN Resolution No. 3,694 dated March 26, 2009, as amended by CMN Resolution No. 3,919 dated November 25, 2010 and CMN Resolution No. 4,283 dated November 4, 2013, established new procedures with respect to the settlement of financial transactions and to services provided by financial institutions to clients and the public in general, aimed at improving the relationship between market participants by fostering additional transparency, discipline, competition and reliability on the part of financial institutions. The new regulation consolidates all the previous related rules. The main changes introduced by the Consumer Defense Code are described below.

- Financial institutions must ensure that clients are fully aware of all contractual clauses, including responsibilities and penalties applicable to both parties, in order to protect the counterparties against abusive practices. All queries, consultations or complaints regarding agreements or the publicity of clauses must be promptly answered, and fees, commissions or any other forms of service or operational remuneration cannot be increased unless reasonably justified (in any event these cannot be higher than the limits established by the Central Bank).

- Financial institutions are prohibited from transferring funds from their clients’ various accounts without prior authorization.

- Financial institutions cannot require that transactions linked to one another must be carried out by the same institution. If the transaction is dependent on another transaction, the client is free to enter into the latter with any financial institution it chooses.

- Financial institutions are prohibited from releasing misleading or abusive publicity or information about their contracts or services. Financial institutions are liable for any damage caused to their clients by their misrepresentations.

- Interest charges in connection with personal credit and consumer directed credit must be proportionally reduced in case of anticipated settlement of debts.

- There must be adequate treatment for the elderly and physically disabled.

Data protection

Brazil enacted the Brazilian General Data Protection Law (Federal Law no. 13,709/2018 or “LGPD”) on August 15, 2018. The LGPD is Brazil’s first comprehensive data protection regulation and it is largely aligned to the EU General Data Protection Act (“GDPR”). Certain LGPD provisions were later amended to, among other modifications, create the National Data Protection Authority (“ANPD”) and postpone its effectiveness to August 2020, rather than February 2020, as set forth when the LGPD was first published.

The LGPD applies to any processing operation carried out by a natural person or a legal entity, of public or private law, irrespective of the means used for the processing, the country in which its headquarter is located or the country where the data are located, provided that:

- The processing operation is carried out in Brazil;

- The purpose of the processing activity is to offer or provide goods or services, or the processing of data of individuals located in Brazil; or

- The personal data was collected in Brazil.

LGPD provides rights to data subjects and several obligations to the processing of personal data (defined as any information related to an identified or identifiable natural person). LGPD also imposes obligations to be observed prior to international transfer of personal data as well as notification requirements in scenarios of data breaches which may cause relevant risk or damage to data subjects.

Prior to the LGPD, data privacy regulations in Brazil consisted of various provisions spread across Brazilian legislation. For example, Federal Law no. 12,965/2014 and its regulating Decree no. 8,771/16 (together, the Brazilian Internet Act), which imposes some requirements regarding on security and the processing of personal data and other obligations on service providers, networks and applications providers, as well as rights of Internet users.

Furthermore, general principles and provisions on data protection and privacy are set forth in the Federal Constitution, in the Brazilian Civil Code and other specific laws and regulations that address particular types of relationships (eg Brazil’s Consumer Defense Code and labor laws), particular sectors (eg financial institutions, health industry and telecommunications) and professional activities (eg medicine and law).

Specially in relation to finance institutions, Resolution no. 4,658/2018 of the Central Bank imposes cyber security requirements and set forth standards for contracting data processing services, such as storage and cloud computing services. The provisions of such Resolution must be observed by financial institutions and other institutions authorized to operate by the Central Bank of Brazil.

Money laundering regulations

Brazilian Law No. 9,613, of March 3, 1998, as amended by Law No. 12,683, of July 9, 2012 (the Anti-Money Laundering Law) plays a major role for those engaged in banking and financial activities in Brazil. The Anti-Money Laundering Law sets forth the definition and the penalties to be incurred by persons involved in activities that comprise the laundering or concealing of property, rights and assets, as well as a prohibition on using the financial system for these illicit acts.

In addition, the Brazilian Anti-Money Laundering Law created the Financial Activity Control Council (Conselho de Controle de Atividades Financeiras or “COAF”). The main role of the Financial Activity Control Council is to promote cooperation among the Brazilian governmental bodies responsible for implementing national anti-money laundering policies, in order to stem the performance of illegal and fraudulent acts. Their activities also include imposing administrative fines and examining and identifying suspected illegal activities pursuant to the Anti-Money Laundering Law.

Canada

General financial regulatory regime

The regulation of financial products and services is a combination of both federal and provincial regimes, which can often be divergent and overlapping.

General

There is not currently a comprehensive regime which specifically regulates FinTech in Canada. However, a person carrying on business in the area of financial products and services will be required to comply with a variety of banking, securities, consumer protection and privacy laws.

Competition Bureau of Canada’s MARKET STUDY REPORT: TECHNOLOGY-LED INNOVATION IN THE CANADIAN FINANCIAL SERVICES SECTOR

After conducting an 18 month long study which included holding a FinTech workshop for stakeholders, founders and regulators held in February 2017, the Competition Bureau of Canada published its market study report in December 2017. The report set out 30 recommendations for regulators and policy makers. 19 of the recommendations identified specific, technical improvements in the areas of retail and payment systems, investment dealing and advice, P2P lending and equity crowdfunding while 11 of the recommendations focused on how to strike the right balance between regulation and innovation. Some of the broader recommendations that the Competition Bureau had for regulators are as follows:

- Principles based regulation – Regulators should adopt a principles-based approach instead of prescribing exactly how a service must be carried out, which would allow for more flexibility with regards to enforcement as technology continues to change.

- Function focused regulation – Regulators should focus on the function that an entity carries out which will ensure that all entities that perform the same function carry the same regulatory burden and consumers have the same protections when dealing with competing service providers.

- Collaboration – Regulators should encourage collaboration throughout the sector, using mechanisms such as regulatory sandboxes and innovation hubs.

- FinTech Policy Lead – Regulators should identify a FinTech policy lead for Canada in order to facilitate FinTech development to provide industry participations with a one-stop resource for information and encourage greater investment in innovative businesses.

- Access, Harmonization and Review – Regulators should promote greater access to core infrastructure and services, continue their efforts to harmonize regulations across jurisdictions in Canada and continue to review their regulatory frameworks frequently.

CANADIAN SECURITIES ADMINISTRATORS BUSINESS PLAN 2019-2022

In June 2019, the Canadian Securities Administrators (CSA) published the CSA Business Plan 2019-2022, which includes considering the development and adaptation of the regulatory framework to address challenges brought by emerging technologies as one of the strategic goals. This goal consists of (i) identifying emerging regulatory issues which require regulatory action or clarity, and (ii) developing a tailored and effective regulatory resposne.

Electronic payments platforms and regulation of peer-to-peer lenders

Electronic payment platforms

Federally-regulated financial instructions (FRFIs) must comply with payment rules and standards set out in the federal Bank Act. The Office of the Superintendent of Financial Institutions (OSFI) regulates, among other things, the payment processing services of FRFIs. FinTech mobile payment providers are not usually FRFIs, and therefore not subject to OSFI oversight. However, FinTech companies are required to comply with various codes of conduct and standards in Canada’s payment industry, including the Code of Conduct for the Credit and Debit Card Industry in Canada and the Canadian NFC Mobile Payments Reference Model.

In July 2017, the federal Department of Finance issued a consultation paper entitled 'A New Retail Payments Oversight Framework', which outlined various aspects of a proposed new framework for regulating retail payments. With limited exceptions, the new proposed framework would apply to any payment service provider (PSP) that is engaged in the following payment functions:

- provision and maintenance of a payment account – providing and maintaining an account held in the name of one or more end-users for the purpose of making electronic fund transfers;

- payment initiation – enabling the initiation of a payment at the request of an end-user;

- authorization and transmission – providing services to approve a transaction and/or enabling the transmission of payment messages;

- holding of funds – enabling end-users to hold funds in an account held with a PSP until it is withdrawn by the end-user or transferred to a third party through an electronic fund transfer; and

- clearing and settlement – enabling the process of exchanging and reconciling the payment items (clearing) that result in the transfer of funds and/or adjustment of financial positions (settlement).

The new oversight framework would only apply to retail payments carried out solely in fiat currencies and not virtual currencies.

The Government of Canada’s 2019 Budget “Investing in the Middle Class” included plans to legislate first measures of a new retail payment oversight framework, drawn from the Department of Finance’s 2017 consultation paper discussed above. These commitments to legislate include end-use fund safeguarding and operational standard requirements, however new legislation has not yet been published to introduce the aforementioned measures.

PAYMENTS MODERNIZATION

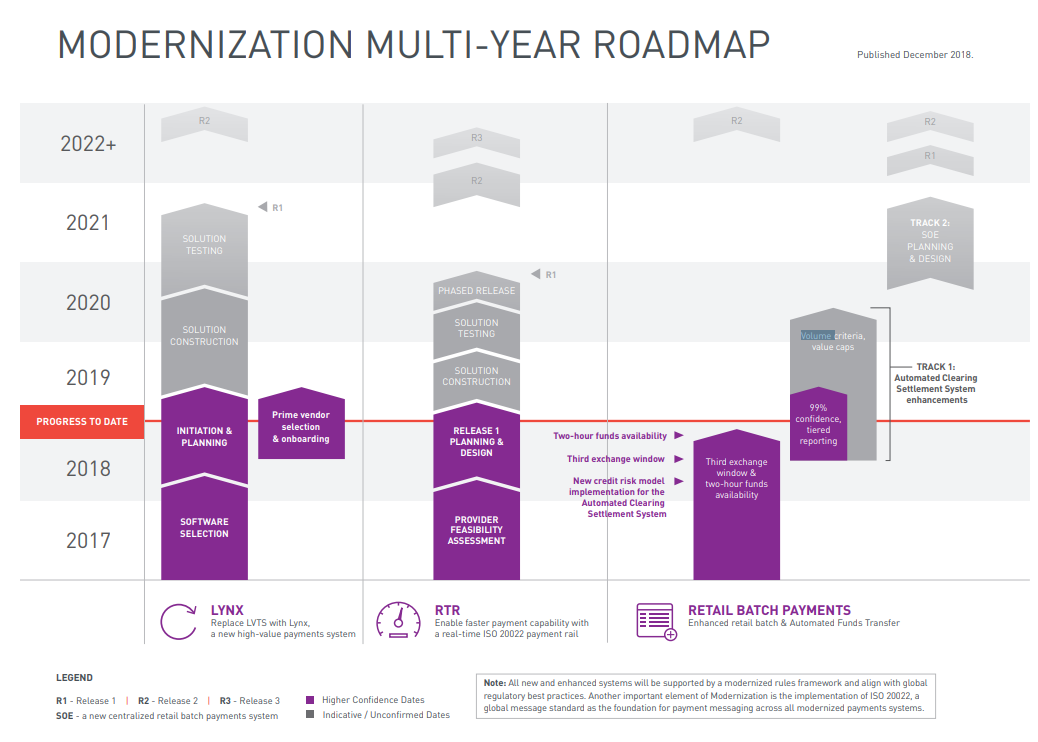

Modernization is a multi-year Payments Canada initiative to modernize the systems and rules that are essential to Canada’s payments ecosystem. In April 2016, Payments Canada published the initial Vision for the Canadian Payments Ecosystem (the “Vision”) and in December 2016 published an Industry Roadmap & High Level Plan which discusses how Payments Canada and the industry can modernize the Canadian payments ecosystem to advance the Vision. On December 21, 2017, Payments Canada published the Modernization Target State, which provides an in-depth view of the target end state for payment system modernization in Canada, including the infrastructure, rules and standards that will benefit Canadians and businesses from coast-to-coast.

Most recently, on December 19, 2018, Payments Canada published the Modernization Delivery Roadmap 2018 Update (the “Roadmap”).The Roadmap provides an update on Canada’s progress on its payments modernization program, which includes implementing a new credit risk model for Canada’s retail payment system and enhancing to Automated Funds Transfer. The Roadmap provides revised timelines for the implementation of the modernization initiative.

The Roadmap discusses:

- High-value payments system - Lynx: The appointment of a prime vendor for hosting and system integration services as an additional step to manage risk and effectively deliver on Payments Canada’s commitment to meet the highest international security, resiliency and operating standards. The prime vendor will support the end-to-end delivery and operations of Lynx, including oversight of SIA, the application provider for Lynx.

- Real-time rail: Clearer articulation of the release schedule for the new real-time payments system in Canada. The first release (referred to as R1) of Canada's new real-time payments system is a foundational release that will deliver the real-time processing of transactions, real-time deposit and real-time availability of funds. R1 will include an enhanced risk model using collateral pledged through the Bank of Canada to support final and irrevocable real-time payments, which will lower settlement risk and support broadening access to new participants; an alias management capability that allows for the routing of payments using an email address or mobile phone number; the capability to carry additional payment information based on ISO 20022 message standards; and the availability of standardized APIs. Future releases of Canada’s new real-time payments rail will build on this foundation, creating opportunities for innovation and competition in the Canadian marketplace.

- Retail batch payments: The prioritization of additional improvements to the current retail batch payments system in advance of progressing to a new, centralized system, which will reduce system risk and support broadening access to members. The additional enhancements to the current system will build on the series of enhancements introduced in 2018. In 2018, modifications were implemented to the existing retail batch payments system, the Automated Clearing and Settlement System (ACSS), that allow Canadian businesses to move funds more frequently and make same day settlements. The delivery date of an enhanced centralized retail batch system has been extended beyond the R1 launch of the Real-Time Rail (RTR) and Lynx. Focus has shifted to the delivery of regulatory enhancements that will reduce system risk including increasing collateral coverage and implementing value caps on individual transactions.

Please see below the Roadmap providing revised timelines for Lynx, the real-time rail and the retail batch payment system.

Peer-to-peer lenders

The scope of regulation and legislation applicable to peer-to-peer (P2P) lenders will depend on the specific nature of the operations; however, P2P lending platforms will typically fund loans or portion of loans and operators of such a platform and will need to be aware of, among other things, Canadian securities law requirements (including prospectus and registration requirements as well as available exemptions) and applicable money laundering, criminal activity and terrorist financing legislation such as the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA).

Regulation of payment services

See Electronic payment platforms above.

Application of data protection and consumer laws

In Canada, the federal Personal Information Protection and Electronic Documents Act (PIPEDA) governs the way private sector organizations may collect, use and disclose personal information in the course of commercial activity. Where provincial privacy legislation governing the private sector’s collection, use and disclosure of personal information has been deemed as 'substantially similar' to PIPEDA, the provincial legislation will apply instead. Alberta, British Columbia and Quebec each have provincial legislation that supersedes PIPEDA in regulating personal information collection, use and disclosure in the private sector.

Canada’s federal Bank Act also contains provisions regulating the use and disclosure pf personal financial information by FRFIs.

Money laundering regulations

The PCMLTFA gives the Financial Transactions and Reports Analyst Centre of Canada (FINTRAC) responsibility for supervising anti-money laundering controls of businesses in Canada that engage in foreign exchange dealing, remittance or transmission of funds, securities dealing, portfolio management and investment advice.

Pursuant to PCMLTFA, businesses are required to verify their clients’ identities, maintain certain records, and report suspicious transactions to FINTRAC.

On July 10, 2019, Canada’s Department of Finance published amendments to the regulations made under the PCMLTFA which are set to come into force on June 1, 2020 and 2021. Among these regulations is an expanded definition of money services businesses to include domestic and foreign business that are dealing in virtual currency (see What is a Cryptocurrency? above). Accordingly, person and entities dealing in virtual currencies will soon be subject to similar obligations as other reporting entities.

Chile

General financial regulatory regime

Most of the regulatory regime for banking and financial services in Chile is established through the General Banking Law, and the regulatory rules of the Chilean Central Bank and the CMF, which prevents non-banking institutions from performing banking activities.

Electronic payments platforms and regulation of peer-to-peer lenders

In Chile there are two well-established electronic payments platforms: Transbank (which is controlled by banks) and Multicaja (which is owned by a private company). There have been several attempts from other non-banking entities to provide similar services, but large financial institutions have been reluctant to partner up with them, making it a difficult area of the market for smaller market players to penetrate.

Banks have further challenged non-banking entities which were providing electronic payment services which they argued constituted performing placement operations, an activity which can only be carried out by regulated banks; however, this claim did not succeed in trial and non-banking entities were permitted to continue providing such services.

Regulation of payment services

In Chile, low cost payment systems, or retail payment systems, are used to carry out transactions among individuals and/or companies. This kind of payment can be made through a variety of methods such as cash, checks, credit and debit card and electronic transfers. Currently in Chile, only certain institutions are allowed to issue this means of payment; however, a new law which allows the issuance and operation of different means of payment by non-banking entities was enacted in October 2016.

Payment services transactions are regulated mainly by the SBIF, which has established a series of technical criteria to ensure that all payment services are reliable and secure.

Application of data protection and consumer laws

Data protection and consumer laws apply equally to FinTech operations. Furthermore, there are specific laws that regulate terms and conditions of consumer loans and financial contracts with consumers (Law No 20,555). There is also a non-privacy and security regulation which is specific to banks, established in article 154 of General Law of Banks. The regulation aims to maintain the confidentiality of the transactions that individuals perform with and through the banks, by classifying them into the following two categories:

- operations covered by secrecy, meaning that they are private and it is therefore not possible to make them known; and

- operations covered by reserve, which imposes a significant limitation on the reporting of such transactions.

Money laundering regulations

The Finance Analysis Unit (UAF) is the dedicated public entity whose purpose it is to prevent the use of the financial systems to commit crimes such as money laundering and financing of terrorism. The UAF is aimed at controlling certain subjects related to financial activities and establishing a series of information obligations, such as:

- keeping registries;

- declaring corporate legal changes;

- reporting cash transactions and transactions that exceed the US$10,000 limit;

- reporting of suspicious activities;

- due diligence and knowledge of their clients (know your customer (KYC));

- keeping records for at least five years;

- training employees; and

- appointing a compliance officer.

The SBIF has also established a series of rules with similar aims.

Colombia

General financial regulatory regime

Regulatory entity

The Financial Superintendence of Colombia (SFC) is a technical entity affiliated with the Ministry of Finance that acts as the inspection, supervision and control authority of persons involved in financial, insurance and securities exchange activities, and any other operations related to the management, use or investment of resources collected from the public. The SFC is responsible for supervising the Colombian financial system with the purpose of preserving its stability and trustworthiness, as well as promoting, organizing and developing the Colombian securities market and protecting the users of financial and insurance services and investors in general.

Financial institutions must obtain the authorization of the SFC before commencing operations. In addition, all public offerings of securities require the prior approval of the SFC.

General

A person must not carry on a regulated activity in Colombia, unless authorized by the SFC. The SFC authorizes the incorporation and operation of all financial institutions. Authorization of the SFC shall be obtained whenever FinTech products or applications involve any financial activity which requires regulatory authorization.

A person undertaking a regulated activity without being authorized or exempt commits a criminal offence and may be liable to imprisonment and economic sanctions.

Project RegTech

The SFC has a FinTech division that seeks to create and develop applications that support regulatory compliance. Currently, the main focus of the FinTech division is to optimize the transmission of information among the different financial controlled entities (ie banks, stock exchange, fiduciaries and financial institutions). This initiative is known as 'project RegTech'.

FinTech subcommittee

In 2016, the Financial Regulation Unity (URF) formed the FinTech subcommittee to provide a formal space in which the public and private sectors may participate and contribute in the construction of FinTech regulations.

The remit of the FinTech subcommittee includes the following:

- robo advisors;

- cloud computing;

- blockchain; and

- algorithm tradition.

The FinTech subcommittee has not yet issued formal guidelines in connection with the abovementioned matters, although it is expected that it will issue these guidelines no later than December 2017.

Asociación Colombiana FinTech

Asociación Colombiana FinTech is a group of entities whose aim is to create a proactive place for the development of FinTech business in Colombia. This association is working in the following areas:

- international transmission of data;

- digital identity;

- digital consultancy;

- digital payment;

- crowdfunding;

- InsurTech;

- bitcoin and blockchain;

- open data for the financial sector; and

- sandboxes.

Electronic payments platforms and regulation of peer-to-peer lenders

Electronic payment platforms

E-commerce is regulated by Law 527 of 1999, known as the Electronic Commerce Law. E-commerce is defined as all issues arising from a commercial relationship, whether contractual or not, originating from the use of one or more data messages or other similar media. Commercial relationships include the following transactions:

- supply or exchange of goods and services;

- distribution agreements;

- agency of mandate agreements;

- all types of financial, securities and insurance operations;

- infrastructure and construction agreements; and

- licensing.

Electronic security is a component of the SFC's operational risk review. Supervised firms are required to design and implement electronic security policies and contingency plans. The SFC establishes minimum requirements for security and quality of information transmitted through electronic channels.

Colombia has adopted measures aimed at reducing regulatory burdens on the financial sector with the aim of encouraging the expansion of access to financial services and to engage in online commerce. As an example, the financial inclusion law allows the creation of nonbank deposit entities known as specialized companies in deposits and electronic payments (SEDPE). SEDPEs are intended to give individuals access to a savings account, and facilitate safe, quick and cheap money transfers. SEDPEs help individuals who do not necessarily own credit or debit cards to carry out online purchases. Moreover, the law allows mobile phone operators to obtain financial licenses from the SFC to operate SEDPEs.

Peer-to-peer lenders

Peer-to-peer lenders are not currently regulated under Colombian law.

Regulation of payment services

The Financial Superintendence of Colombia has regulatory and supervisory authority over financial entities regarding payment services.

In addition, the Banco de la República (Central Bank or BR) is responsible for monetary policy and foreign exchange. It has the authority to adopt certain macroprudential measures, manages and exercises surveillance functions over the payment system, provides liquidity to markets, and acts as a lender of last resort.

Application of data protection and consumer laws

Data protection and consumer regulations

Law 1266 of 2008, Law 1581 of 2012 and Decree 1337 of 2013, each regulate data collection and processing by any financial, commercial and credit institution. The regulations differentiate between the controller and the processor of the data. The data controller is any individual or legal, public or private entity, which by itself or in association with others, makes decisions regarding the database or the treatment of the data and is responsible for it. The data processor is any natural or legal, public or private entity, which by itself or in association with others, processes personal data on behalf of the controller.

Difference between transferring of data and transmission of data

Regulations differentiate between the transferring of data and the transmission of data. The transferring of data is the operation in which the data controller of the personal data within Colombia sends the information to a receptor (in Colombia or abroad). In this case, the receptor also becomes responsible for the data processing, and therefore shall comply with all applicable laws. Transferring data to foreign countries is prohibited, unless the recipient foreign country is deemed to provide an adequate level of data protection. The transferring prohibition shall not apply, however, in the following cases:

- the owner of the data has authorized the transfer;

- exchange of medical information;

- bank transfers;

- transfers in accordance with international treaties;

- transfer is required due to the existence of an agreement between the owner of the information and the data controller; and

- legally required transfer in order to safeguard public interest.

Any event different from the above mentioned, requires the authorization of the Colombian Superintendence of Industry and Commerce (SIC).

For instance, the transmission of data is the communication between the data controller and the data processor in which the data is sent by the data controller and processed by the data processor on behalf of the data controller. International transmission does not require the authorization of the data owner, as long as an agreement has been executed between the data controller and data processor.

Money laundering regulations

Firms that are supervised and controlled by the SFC must implement an asset laundering and financing terrorism risk management system (SARLAFT) in order to prevent money laundering and terrorist financing. The SFC has the responsibility to report to the Special Administrative Unit and Financial Analysis (UIAF) any operations conducted by controlled or supervised firms that may be categorized as suspicious, in order for the UIAF to initiate an investigation.

The UIAF has the responsibility to detect, prevent and overcome practices related to money laundering and financing of terrorism by centralizing and analyzing all of the information collected in the exercise of its faculties.

Czech Republic

General financial regulatory regime

The Czech National Bank (CNB) is the conduct regulator for firms providing financial products and services in both retail and wholesale markets.

General

A person must not carry on a regulated activity in the Czech Republic unless authorized or exempt (known as the general prohibition). A financial activity requires regulatory authorization when it is identified as a specified activity in relation to a specified investment, it is carried on by way of business in the Czech Republic and it does not fall within any of the available exemptions. Where FinTech products and/or applications involve financial activity which requires regulatory authorization, the firms providing such products and/or applications must be authorized by the CNB.

Peer-to-peer lending

A person carries out a regulated activity (requiring authorization by the CNB) if they facilitate lending and borrowing between two individuals or between individuals and businesses in its ordinary course of business.

Regulation of payment services

Where a Czech business provides payment services as a regular occupation or business activity in the Czech Republic, it will require authorization by the CNB to become an authorized payment institution under the Payment Services Regulations 2017. Failure to obtain the required authorization is a criminal offence. The regulations implement the European Union Payment Services Directive II.

In order to become authorized by the CNB, a payment services business will need to meet certain criteria, including in relation to its business plan, initial capital, processes and procedures in place for safeguarding relevant funds, sensitive payment data and money laundering and other financial crime controls.

Application of data protection and consumer laws

The Czech Act No. 101/2000 Coll. on the Protection of Personal Data (DPA) regulates the processing of personal data within the Czech Republic. The DPA implements the European Data Protection Directive. Where a business determines the purposes and manner in which any personal data is processed, it will be regulated by the DPA and have certain notification and compliance obligations.

The European General Data Protection Regulation (GDPR) is due to replace the DPA from 25 May 2018 (which will result in a newly drafted Czech Act reflecting the provisions of the GDPR). The GDPR is more prescriptive and restrictive compared to the principles-based DPA, including mandatory notifications where a breach occurs and provides for severe monetary sanctions for breach.

Money laundering regulations

The Czech Act No. 253/2008 Coll. on certain measures against legalization of revenues from criminal acts and financing of terrorism, as amended, gives the CNB responsibility for supervising the anti-money laundering controls of businesses that offer certain services, such as lending, providing payment services and issuing and administering other means of payment. This act also implements the European Union's Fourth Money Laundering Directive.

Generally, where a firm is authorized and supervised by the CNB it will also be authorized and supervised by the CNB for complying with anti-money laundering requirements. Electronic currencies such as bitcoin and cryptocurrencies tend to represent a higher money laundering risk.

Finland

General financial regulatory regime

The Finnish Financial Supervisory Authority (FIN-FSA) is the regulator for firms providing financial products and services in both retail and wholesale markets.

General

A person must not carry on a regulated activity in Finland unless authorized or exempt. A financial activity requires regulatory authorization when it:

- is identified as a specified activity in relation to a specified investment;

- is carried on by way of business in Finland; and

- does not fall within any of the available exemptions.

Where FinTech products and/or applications involve financial activity which require regulatory authorization, the firms providing such products and/or applications must be authorized by the FIN-FSA.

FIN-FSA Innovation Help Desk

To foster the growth and development of startup companies and other innovators, the FIN-FSA has set up an Innovation Help Desk to advise whether an innovation requires authorization and to advise further on permits, registration and other authorization issues. The FIN-FSA Innovation Help Desk is available to both startup companies in the sector and enterprises that are already established and are planning a new type of product, service or way of operating. More information can be found here.

Virtual currency

The Act on virtual currency providers (572/2019) entered into force 1 May 2019. The Act is part of the national implementation of the EU's Fifth Anti-Money Laundering Directive. According to the definition, a virtual currency means a digital representation that is not issued or guaranteed by a central bank or a public authority, is not necessarily attached to a legally established currency and does not possess a legal status of currency or money, but is accepted by natural or legal persons as a means of exchange and which can be transferred, stored and traded electronically. Further FIN-FSA regulations and guidelines 4/2019 concerning virtual currency providers enter into force on 1 July 2019.

According to the Act on virtual currency providers, virtual currency issuers, operators of virtual currency exchange services (including marketplaces) and providers of virtual currency custodian wallet services are subject to a registration obligation as of 1 May. Virtual currency providers operating in the market prior to the entry into force of the Act must submit an application for registration with the FIN-FSA by 18 August 2019 in order that their qualification for registration can be assessed by 1 November. New providers considering the launch of activities after the entry into force of the Act may only provide services to customers after their applications for registration have been processed and approved.

Virtual currency providers are considered obliged entities under the Anti-Money Laundering Act as of 1 December 2019, which means that they must report suspicious transactions to the Financial Intelligence Unit of the Police. The FIN-FSA supervises the actions and measures of virtual currency providers related to anti-money laundering and counter-terrorist financing.

Crowdfunding services and peer-to-peer lenders

Crowdfunding services

The Crowdfunding Act (Fi: Joukkorahoituslaki 734/2016, as amended) (Crowdfunding Act) entered into force in September 2016. The objective of the Crowdfunding Act was to clarify the responsibilities of various authorities in the supervision of crowdfunding, to improve investor protection, to diversify the financial markets and to ease the regulation on entities offering crowdfunding services.

The Crowdfunding Act covers both loan-based crowdfunding and investment-based crowdfunding (ie which involves the issue of securities or other instruments), but is not applied to either peer-to-peer (P2P) lending or to money collection. Under the Crowdfunding Act, entities offering crowdfunding services (ie crowdfunding intermediaries) must have a permit issued by, and entered in, a register maintained by the FIN-FSA. Depending on the operating model of the crowdfunding intermediary, the operations may also be subject:

- to other regulations, such as the:

- Money Collection Act (Fi: Rahankeräyslaki 255/2006, as amended);

- Sale of Goods Act (Fi: Kauppalaki 355/1987, as amended) and;

- Consumer Protection Act (Fi: Kuluttajansuojalaki 38/1978, as amended) (as is the case with loan-based crowdfunding); or

- to financial markets legislation, such as the:

- Credit Institutions Act (Fi: Laki luottolaitostoiminnasta 610/2017, as amended);

- Investment Services Act (Fi: Sijoituspalvelulaki 747/2012, as amended);

- Act on Alternative Investment Fund Managers (Fi: Laki vaihtoehtorahastojen hoitajista 162/2014, as amended); and

- Securities Markets Act (Fi: Arvopaperimarkkinalaki 746/2012, as amended) (with investment-based crowdfunding).

Intermediaries providing services under the Crowdfunding Act are within the optional exemption available to European Union member states under article 3 of the Markets in Financial Instruments Directive (MiFID 1). This means that crowdfunding intermediaries operating under the Crowdfunding Act do not require authorization as MiFID investment firms. Consequently, entities permitted by FIN-FSA to offer crowdfunding services are not within the European Union passporting regime and may not offer crowdfunding services in other European Economic Area (EEA) countries and, vice versa, entities authorized in other EEA countries may not offer such services in Finland without FIN-FSA’s permission. It should be noted, however, that this position does not apply to entities which have been authorized to carry out a regulated activity which is within the scope of MIFID I. These include inter alia credit institutions operating under the Credit Institutions Act (Fi: Laki luottolaitostoiminnasta 610/2017, as amended) and investment firms operating under the Investment Services Act (Fi: Sijoituspalvelulaki 747/2012, as amended). Such entities may act as crowdfunding intermediaries under their authorization without needing separate permission for crowdfunding services.

Peer-to-peer lenders

P2P lending so far, requires no authorization; hence, for example, the administrative staff, internal control or risk management systems of a P2P lending intermediary are not subject to official supervision. This also means that there is no supervision of the credit ratings that may be assigned to borrowers by P2P lending companies. However, authorities have decided that certain participating parties in P2P lending must be entered in a register of credit providers maintained by, and must be supervised by, the Regional State Administrative Agency of Southern Finland (Fi: Etelä-Suomen aluehallintovirasto). Under the Act on Registration of Certain Loan Providers and Credit Brokers (Fi: Laki eräiden luotonantajien ja luotonvälittäjien rekisteröinnistä 853/2016, as amended) the lending intermediary must be registered in the register maintained by the Regional State Administrative Agency of Southern Finland if they provide consumer credit or are considered to offer consumer credit, as defined in the Consumer Protection Act (Fi: Kuluttajansuojalaki 38/1978, as amended) or if they act as an intermediary in P2P lending.

Regulation of payment services

Payment services include, for example, account transfers, card payments and direct debits (where the service provider acts as intermediary between payer and payee and transfers funds between the parties in accordance with given instructions). In Finland, payment services can only be provided by service providers that meet the requirements laid down in the Payment Institutions Act (Fi: Maksulaitoslaki 297/2010, as amended), either acting as authorized payment institutions or entities that the FIN-FSA has approved for the provision of payment services without actual authorization.

Payment services can be provided without authorization, as long as the total value of completed transactions does not exceed:

- for natural persons, an average of €50,000 a month over a period of 12 months; and

- for legal persons, an average of €3 million a month.

However, those providing payment services without authorization must submit a notification to FIN-FSA prior to the commencement of the service. After receiving such a notification, FIN-FSA investigates whether the service provider meets the statutory requirements.

- A natural person cannot be authorized as a payment institution.

- Legal persons must apply for authorization as a payment institution if the total value of their payment services exceeds the above-mentioned limit.

- A credit institution may provide payment services based on its own authorization.

- A foreign payment institution authorized in EEA may also provide payment services in Finland, provided that proper notification is made to FIN-FSA.

The legal requirements for the provision of payment services, such as the disclosure requirements and contract terms and conditions, are laid down in the Payment Services Act (Fi: Maksupalvelulaki 290/2010), as amended. It regulates, for example, the service provider's obligation to provide information to end users on the terms of the relevant agreement governing the provision of the services and executed payments. It also regulates how payments are executed, what the terms and conditions are, and what responsibilities the parties have.

FIN-FSA supervises terms and conditions, disclosure obligations and the carrying out of such services in respect of payment institutions, credit institutions and their agents.

The European Union’s Payment Services Directive II has been transposed into Finnish law through changes to the Payment Institutions Act and the Payment Services Act. It can be noted that the FIN-FSA complies with European Banking Authority’s proposed additional time for strong customer authentication in e-commerce card-based payments and such requirements must be implemented by 31 December 2020.

Application of data protection and consumer laws

General principles of processing and disclosing personal data are regulated by the European General Data Protection Regulation (GDPR), supplemented by the Personal Data Act of Finland (Tietosuojalaki 1050/2018, as amended). Criminal liability may ensue if obligations of the Data Protection Act are not followed.

In addition to sector-specific regulations, general consumer protection regulation applies to the provision of payment services to consumers. A consumer is defined in the Consumer Protection Act (Fi: Kuluttajansuojalaki 38/1978, as amended) as a natural person who acquires consumer goods and services primarily for other purposes than to his or her professional purposes. The Finnish consumer ombudsman supervises the terms and conditions and disclosure obligations and the carrying out of such services in respect of payment services providers without authorization, where the users of the service are consumers.

Money laundering regulations

Payment services providers must comply with anti-money laundering requirements as provided in the new Finnish Act on Preventing Money Laundering and Terrorist Financing (Fi: Laki rahanpesun ja terrorismin rahoittamisen estämisestä 444/2017, as amended), which entered into force in July 2017. The new Act implements the European Union's Fourth Money Laundering Directive.

France

General financial regulatory regime

The Prudential and Resolution Supervisory Authority (Autorité de contrôle prudentiel et de résolution or ACPR) and the Financial Markets Authority (Autorité des Marchés Financiers or AMF) are the supervising entities and regulators of firms providing banking and financial products and services.

General

A person must not carry on a regulated activity in France unless authorized or exempted. A banking or financial activity requires regulatory authorization when it is identified as a regulated activity, carried on by way of business on a regular basis in France and it does not fall within any of the available exemptions. Where FinTech products and/or applications involve banking or financial activity which requires regulatory authorization, the firms providing such products and/or applications must be authorized by the ACPR or the AMF.

ACPR’s FinTech Innovation Unit

The FinTech Innovation Unit is the ACPR team dedicated to FinTech and to innovative project initiators. The unit provides an interface between project initiators and the relevant ACPR departments, as well as the Bank of France (for projects regarding payment services) and the AMF (for projects regarding investment services). The ACPR considers that an innovative financial project consists of the creation of a company ('startup style') with a strong level of innovation and acting in one or several financial fields under ACPR’s supervision.

AMF’s FinTech, Innovation and Competitiveness Division

The AMF’s FinTech, Innovation and Competitiveness Division assists stakeholders in analysing innovations in the investment services industry, identifying competitiveness and regulation challenges and, where applicable, evaluating the need to modify European regulations or the AMF policy. The ambition of the AMF is to develop an ecosystem that promotes FinTechs in order to make the Paris financial centre more attractive to foreign participants and facilitate the development and support of FinTechs.

Electronic payments platforms and regulation of peer-to-peer lenders

Electronic payment platforms

Electronic payment platforms’ activities are generally considered as regulated payment services activities requiring a payment institution authorization with the ACPR. Electronic payments platforms may also be authorized as lightly-supervised payment institutions if they do not exceed the threshold of an average volume of monthly payment transactions of EUR3 million. Depending on their features, such platforms may also trigger other qualifications and regulatory regimes, and notably, enter into the scope of the new “Pacte” law (dated 22 May 2019) – digital assets framework,

Peer-to-peer lenders

A person carries out a regulated banking activity if they provide lending or facilitate lending and borrowing between individuals or between individuals and businesses, in particular through an electronic platform, by way of business on a regular basis. Such regulated activity can be carried out if the person is authorized as a credit institution or financing company, or, if the person is registered as a crowdfunding intermediary.

Crowdfunding intermediaries

Any person or entity proposing, through a website, to fund projects in the form of a loan with or without interest must be registered in the Banking, Insurance and Financial Intermediaries Register (ORIAS), as a crowdfunding intermediary. Crowdfunding intermediaries are subject to organizational and business conduct rules (in particular information obligations).

Regulation of payment services

Where a person provides payment services as a regular occupation or business activity in France, it will require authorization by the ACPR to become an authorized payment institution. Failure to obtain the required authorization is a criminal offence.

In order to become authorized by the ACPR, a payment services business will need to meet certain criteria, including in relation to its business plan, initial capital, processes and procedures in place for safeguarding relevant funds, sensitive payment data and money laundering and other financial crime controls.

PSD 2 regulation, as implemented into French law, has broaden the scope of payment service, which now extended to payment initiation and aggregation of payments.

Money laundering regulations

The Monetary and Financial Code (CMF), which will implement the European Union's Fifth Money Laundering Directive by 10 January 2020, contains the legal provisions governing anti-money laundering and terrorism financing. The ACPR and AMF are responsible for supervising the compliance of regulated banking and financial entities with anti-money laundering requirements.

The CMF expressly includes platforms facilitating the trade of virtual currencies under the scope of the anti-money laundering legal and regulatory framework.

Germany

General financial regulatory regime

The Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht or BaFin), and the Deutsche Bundesbank are the regulatory authorities in Germany with respect to firms providing banking or financial products and services.

A person must not carry out a regulated activity in Germany unless authorized or exempt under the German Banking Act or the Payment Services Supervision Act. Where FinTech products or applications involve any financial activity which requires regulatory authorization, the firms providing such products or applications must obtain such authorization prior to commencing their regulated business activity. Carrying out regulated activities without the necessary authorization is a criminal offence.

The BaFin has published guidance for FinTech companies, in particular as to the question of whether certain business activities (eg crowdlending, crowdinvesting or robo advice) require a license in Germany.

Banks and financial services providers

Any FinTech provider that either conducts banking business or provides financial services must obtain a prior written authorization under the German Banking Act.

Regulation of payment services

Payment services providers are regulated under the Payment Services Supervision Act and require a prior written authorization by the BaFin for carrying out payment services.

Application of data protection and consumer laws

FinTechs dealing with consumers must comply with all relevant consumer protection laws (eg in relation to information obligations). FinTechs must also comply with the applicable data protection legislation, in particular if they come in contact with any personal data.

Money laundering regulations

Generally, where a firm is authorized as either a financial institution or a payment services provider it will need to comply with the regulations on money laundering, in particular with the requirements set out in the German Money Laundering Act.

Ghana

General financial regulatory regime

Other than as specified in this section, there are as yet no fintech-specific laws or regulations. Where fintech businesses engage in regulated activity such as deposit-taking, lending, insurance or investment, they are subject to the rules generally applicable to those activities.

The Payment Systems and Services Act, 2019 (Act 987) which entered into force on 14 May 2019 establishes a regime of licensing and regulation by the central bank of payment service providers, operators of payment systems, and electronic money issuers. Existing operators have been given nine months to comply with the new regime. It is not yet clear if all electronic payment platforms will be regulated as payment systems under the Act.

A payment service provider or electronic money issuer must have at least 30% Ghanaian ownership. The Bank of Ghana may prescribe minimum capital requirements.

Regulations under the Payment Systems and Services Act are to be issued by the Minister of Finance on the advice of the central bank.

Application of data protection

A registration certificate from the Data Protection Commission is required in an application for a license by a payment service provider or electronic money issuer. The data protection principles enacted in the data protection legislation apply to entities providing these services.

Consumer laws

Consumer protection principles, including transparency, disclosure of sufficient information, fair treatment and client access to redress are laid down in Act 987. The central bank has the authority to make final determination of complaints by clients against payment services providers and electronic money issuers.

Money laundering regulations

Fintech businesses are likely to belong to the extensive list of entities identified as “accountable institutions” under the anti-money laundering legislation e.g. as businesses which provide financial services that involve the remittance or exchange of funds; they are therefore subject to record-keeping, due diligence, client identification and verification, reporting and disclosure obligations and liable to sanctions prescribed for breach of these obligations.

Cryptocurrency

The Securities and Exchange Commission and the Bank of Ghana have both issued directives on cryptocurrency indicating that they do not license or regulate cryptocurrency. Act 987 does not appear to have changed that position.

Hungary

General financial regulatory regime

The National Bank of Hungary (National Bank) is the conduct regulator for firms providing financial products and services in both retail and wholesale markets, and also the prudential regulator for many firms. It is also responsible for enforcing the market abuse and listing regimes.

General

Under Hungarian law, carrying on finance and investment activities by way of business is subject to government authorization. All financial institutions/investors must apply to the National Bank for authorization. The National Bank will also approve key individuals (eg senior management) in their roles. Authorized firms and individuals are listed on the Registry of the National Bank. Where FinTech products and/or applications involve financial activity which requires regulatory authorization, the firms providing such products and/or applications must be authorized by the National Bank.

Regulatory developments on investment platforms

The Hungarian regulatory framework on investment platforms follows the direction of European Union developments.

Electronic payments platforms and regulation of peer-to-peer lenders

Electronic payment platforms

Act CCXXXV of 2013 on Payment Service Providers (Payment Service Act) regulates the establishment and the operation of electronic payment platforms. A number of FinTech businesses are offering electronic payment platforms to rival the traditional payment systems. The Payment Service Act and Act CCXXXVII of 2013 on Credit Institutions and Financial Enterprises (Financial Institutions Act) contain a number of electronic money (e-money)-related rules, aimed at businesses that are issuing or considering the issuance of e-money. E-money is defined by the Financial Institutions Act as electronically, including magnetically, stored monetary value as represented by a claim on the issuer of the e-money which is issued on receipt of funds for the purpose of making payment transactions, and which is accepted by a natural or legal person, unincorporated business association or private entrepreneur other than the e-money issuer. Generally, firms issuing e-money must be authorized or registered with the National Bank.

Peer-to-peer lenders

A person carries out a regulated activity (requiring authorization by the National Bank) if they facilitate lending and borrowing on a commercial scale.

Regulation of payment services

Under Hungarian law, carrying on finance and investment activities by way of business is subject to authorization. By way of business means gainful (for-profit) economic activities performed on a regular basis for compensation, involving the conclusion of deals which have not been individually negotiated. In order to become authorized by the National Bank, a payment services business needs to meet certain criteria, including in relation to its business plan, initial capital, processes and procedures in place for safeguarding relevant funds, sensitive payment data and money laundering and other financial crime controls.

Application of data protection and consumer laws

The Act CXII of 2011 on the Right of Informational Self-Determination and on Freedom of Information (Data Protection Act) regulates the processing of personal data within Hungary. The Data Protection Act implements the European Data Protection Directive. Where a business determines the purposes and manner in which any personal data is processed, it will be regulated by the Data Protection Act and have certain notification and compliance obligations. In addition, Act CVIII of 2001 on Electronic Commerce and on Information Society Services stipulates further data protection provision related to transactions made through electronic commerce.

The European General Data Protection Regulation (GDPR) is set to come into effect on 25 May 2018. The GDPR is more prescriptive and restrictive compared to the Data Protection Act, including mandatory notifications where a breach occurs and provides for severe monetary sanctions for breach.

Money laundering regulations

Act LIII of 2017 on the Prevention and Combating of Money Laundering and Terrorist Financing gives the National Bank responsibility for supervising the anti-money laundering controls of businesses that offer certain services, such as lending, providing payment services and issuing and administering other means of payment. These regulations implement the European Union's Fourth Money Laundering Directive.

Generally, where a firm is authorized and supervised by the National Bank it will also be authorized and supervised by the National Bank for complying with anti-money laundering requirements. Electronic currencies such as bitcoin and cryptocurrencies tend to represent a higher money-laundering risk.

Ireland

The Central Bank of Ireland is the conduct regulator providing financial products in both retail and wholesale markets.

General